Connected financial intelligence and control for tomorrow’s CFO

Finmo turns disparate financial data across your business into connected, future-facing intelligence, and act on it with speed and confidence.

Treasury management for mid-market CFOs

Deep realtime global payment network

Integrations across bank accounts, ERPs and Accounting Softwares

The challenge

How Finmo solves it

Cash Management Blind Spots

Finance teams lack real-time visibility into balances across banks, entities, and currencies. Liquidity remains fragmented, slowing decision-making

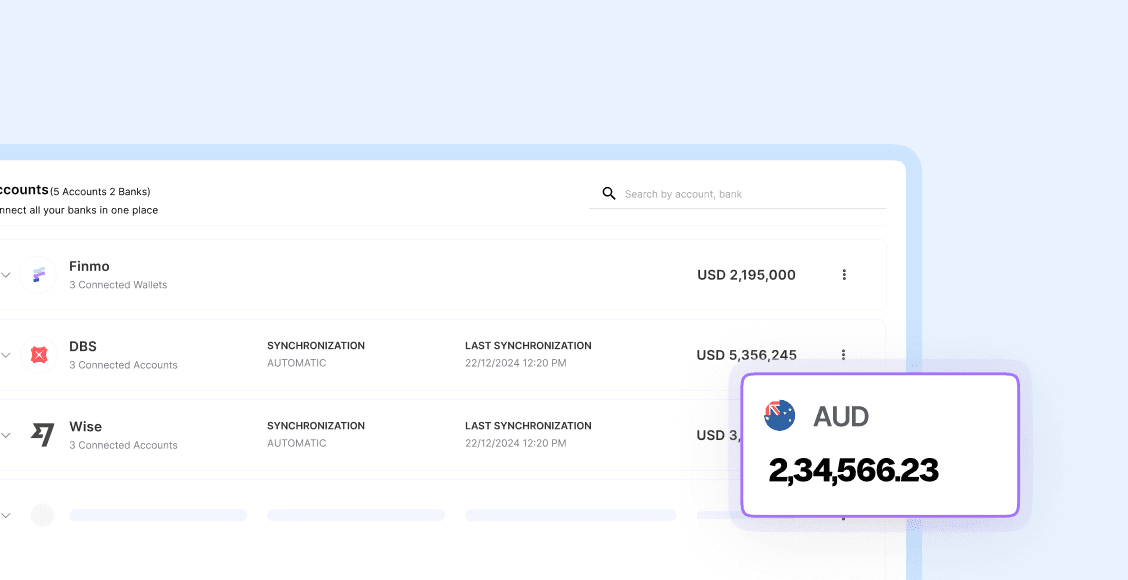

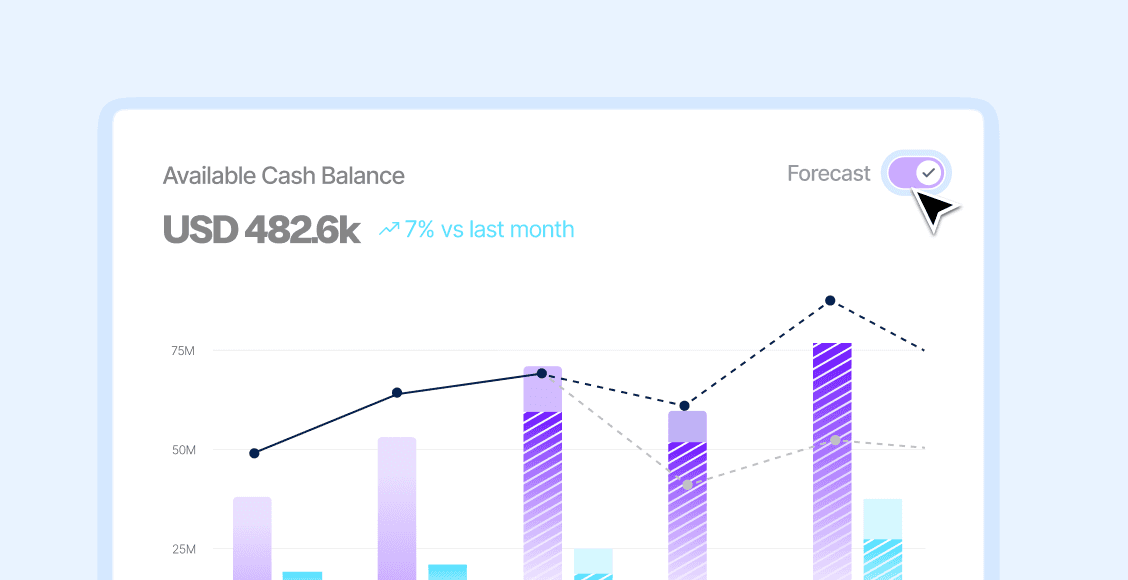

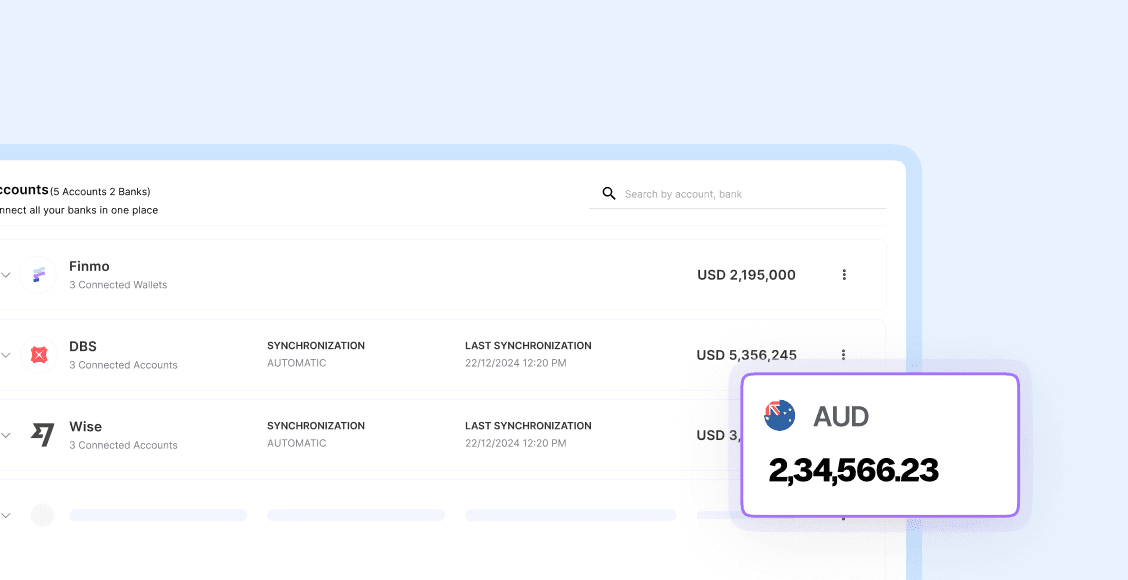

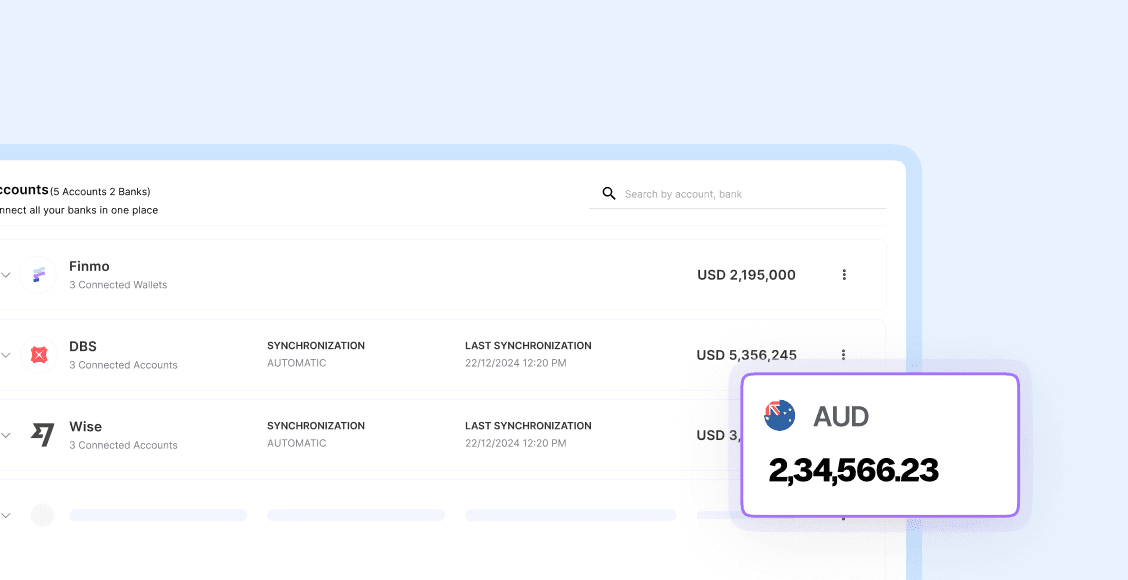

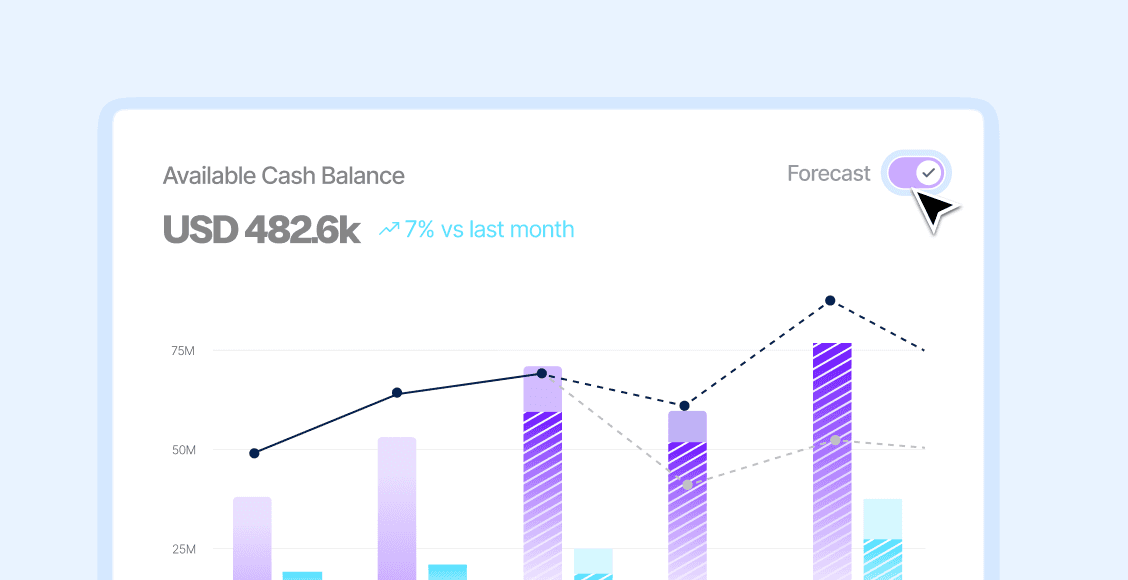

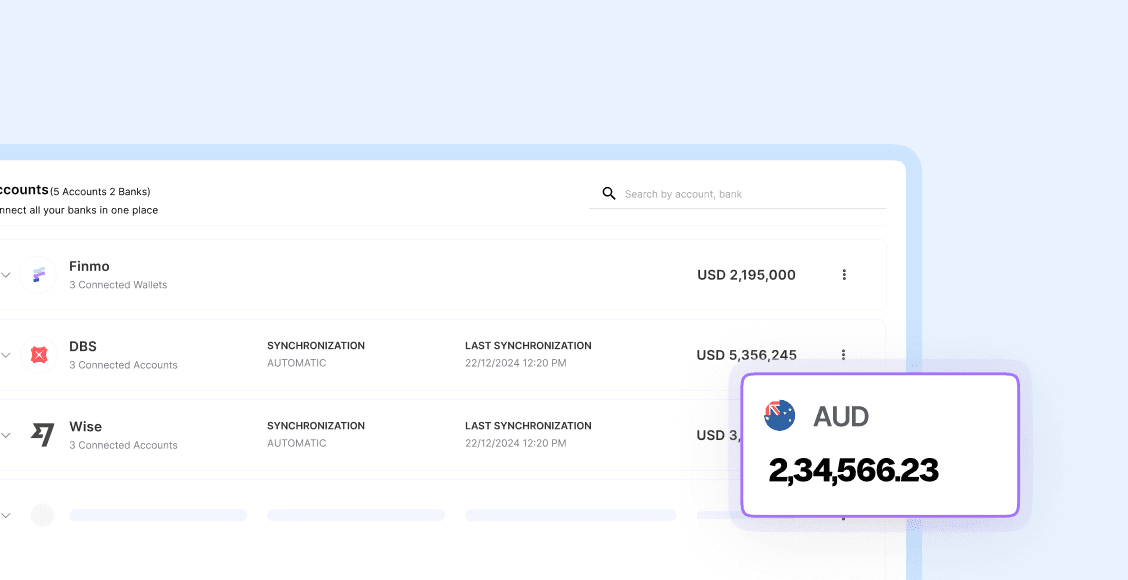

Real-time cash visibility

Connect directly with banking partners to stream bank statement data in real time. CFOs gain instant, consolidated visibility into cash positions across the business.

Working Capital Constraints

Idle balances and trapped receivables/payables limit growth and prevent CFOs from deploying capital strategically.

Liquidity Management

Forecasting and scenario planning help CFOs optimize working capital, unlock liquidity, and redeploy capital to fuel growth.

Payment Fragmentation

Managing AR/AP globally requires multiple integrations with different providers, driving complexity and maintenance overhead.

Orchestrate commercial payments, both collect in 40 currencies and send money to 180+ currencies with Finmo’s global payment network without the burden of managing individual integrations.

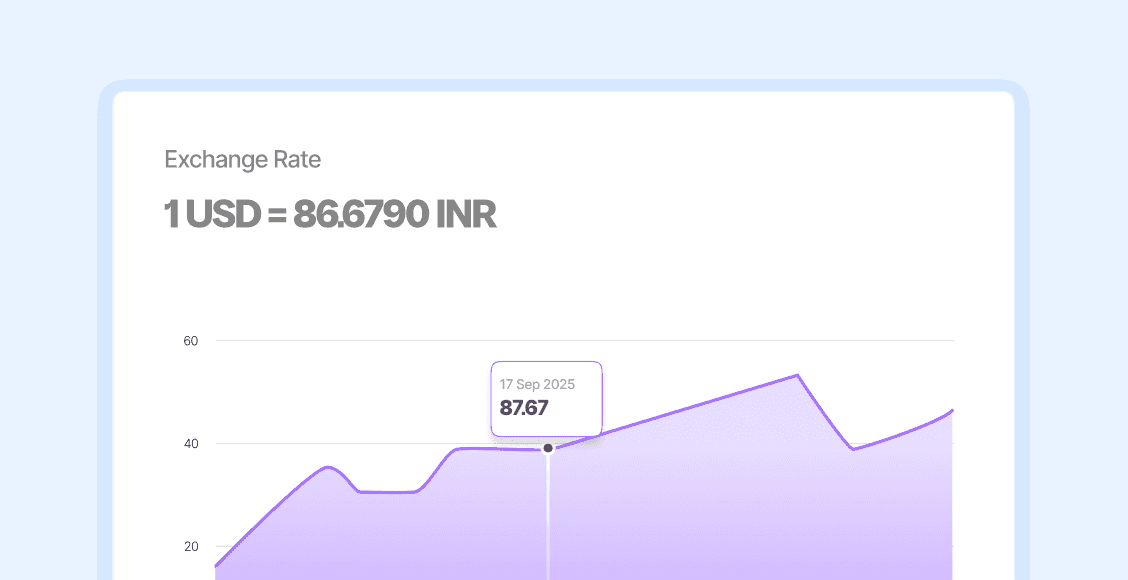

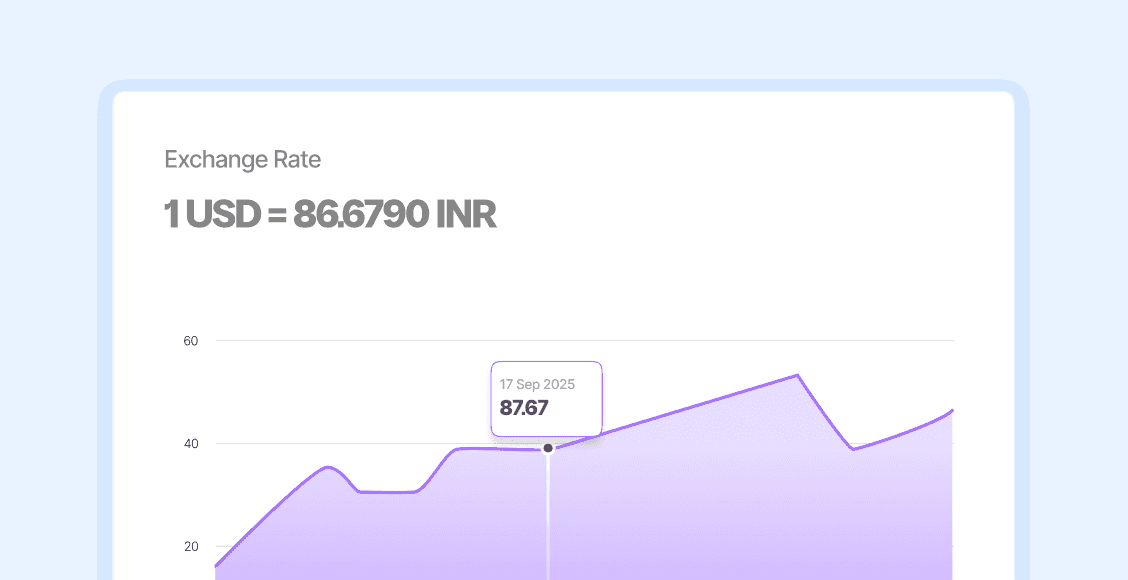

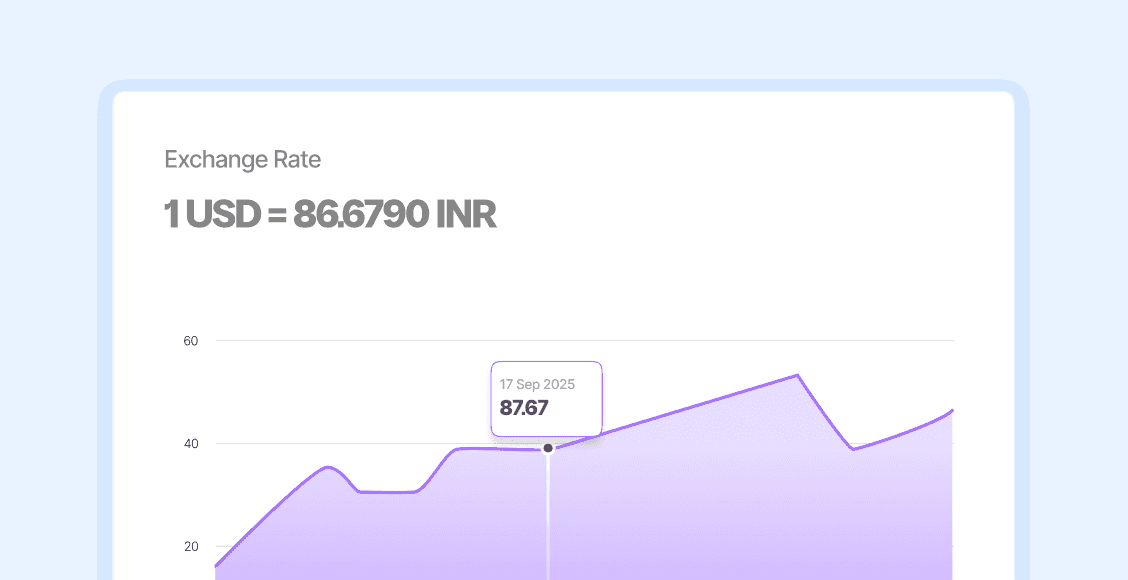

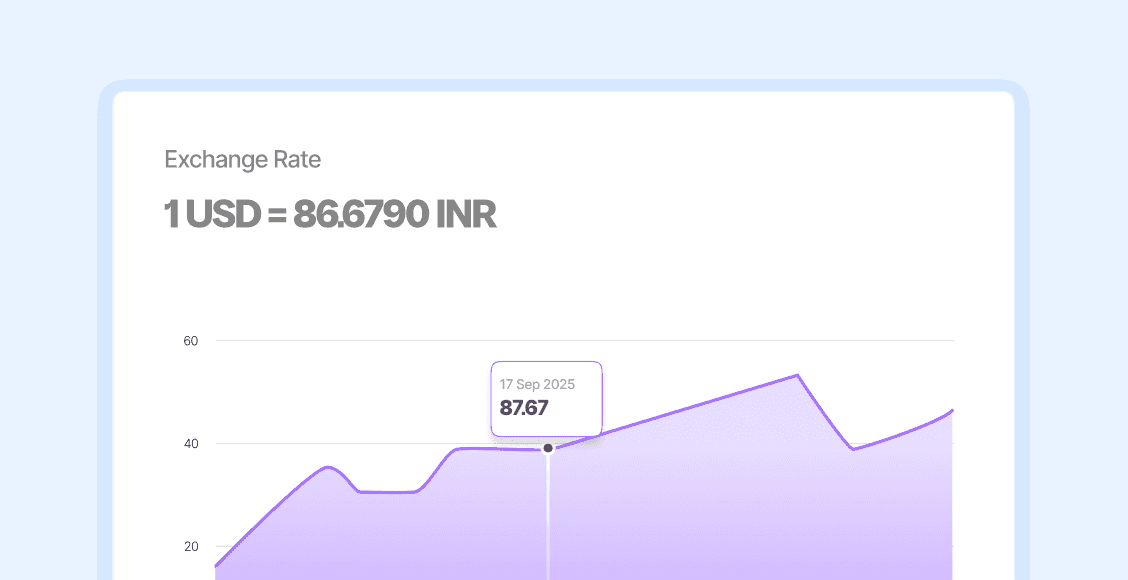

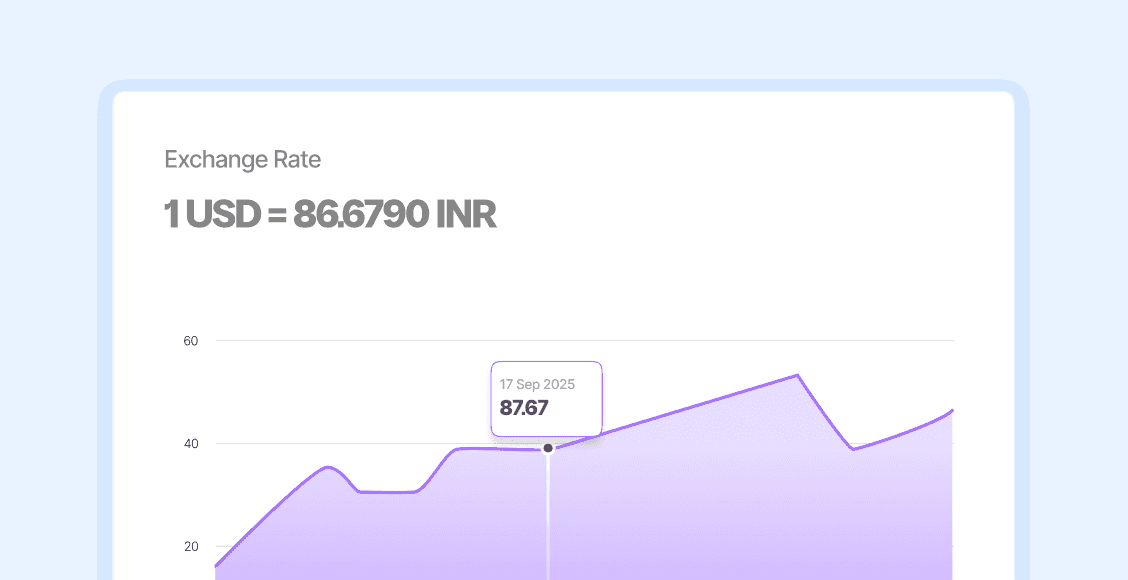

FX Risk & Margin Leakage

Multi-currency transactions expose businesses to volatility, hidden spreads, and settlement delays that quietly eat into margins.

Leverage Finmo’s global payment network and built-in FX intelligence to cut intermediary costs, hedge exposures, and protect margins.

Strategic Decisions

CFOs struggle to act on data when planning investments or managing runway. Data compilation takes forever, leaving little time for actual decision-making.

Consolidate bank balances across entities and currencies, along with receivables and payables data, to gain full visibility into your cash position.

Product

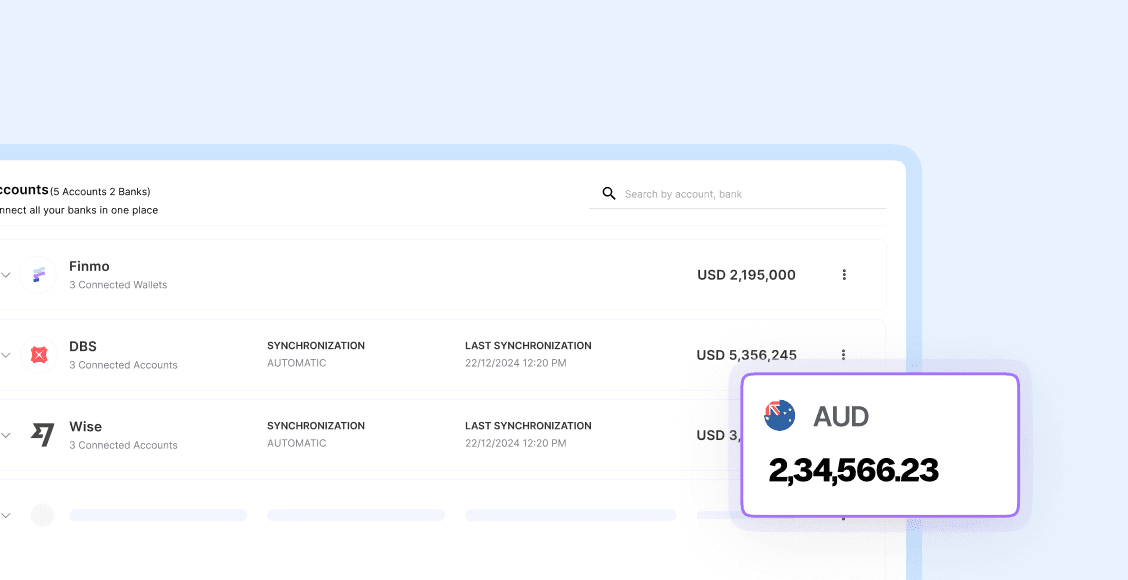

Real-time cash visibility

Get a 360° view of global cash positions across all bank accounts, entities, currencies and investments, giving finance leaders the clarity to act faster.

Global payments & FX

Streamline international transactions with a global payments infrastructure. Collect payments in 40+ currencies, pay out to 180+ countries, and settle faster through 15+ banking partners. FX is built in so you protect margins and cut conversion costs as you scale.

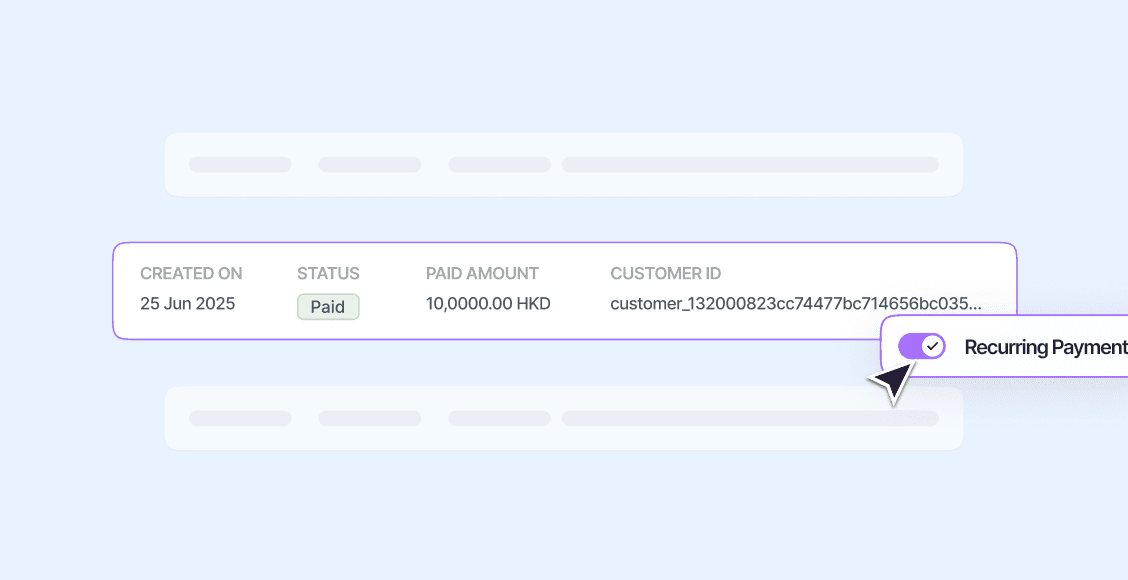

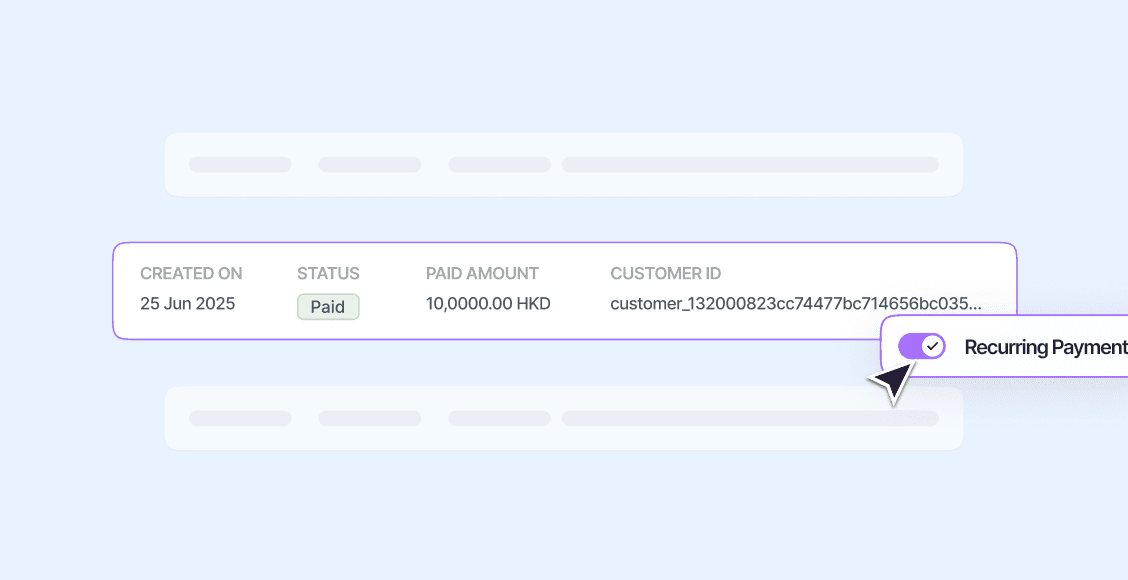

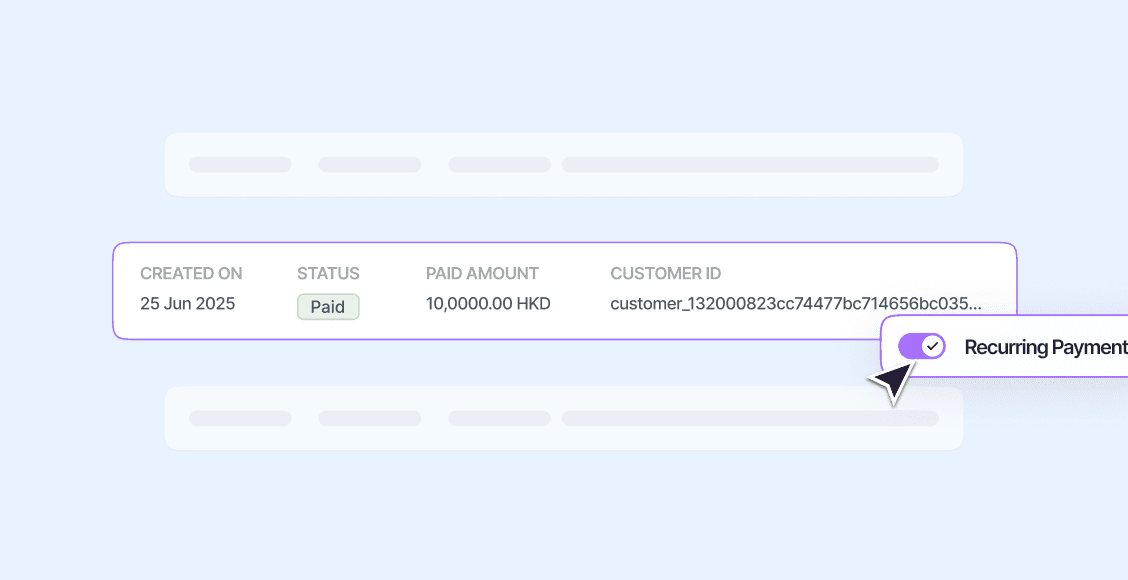

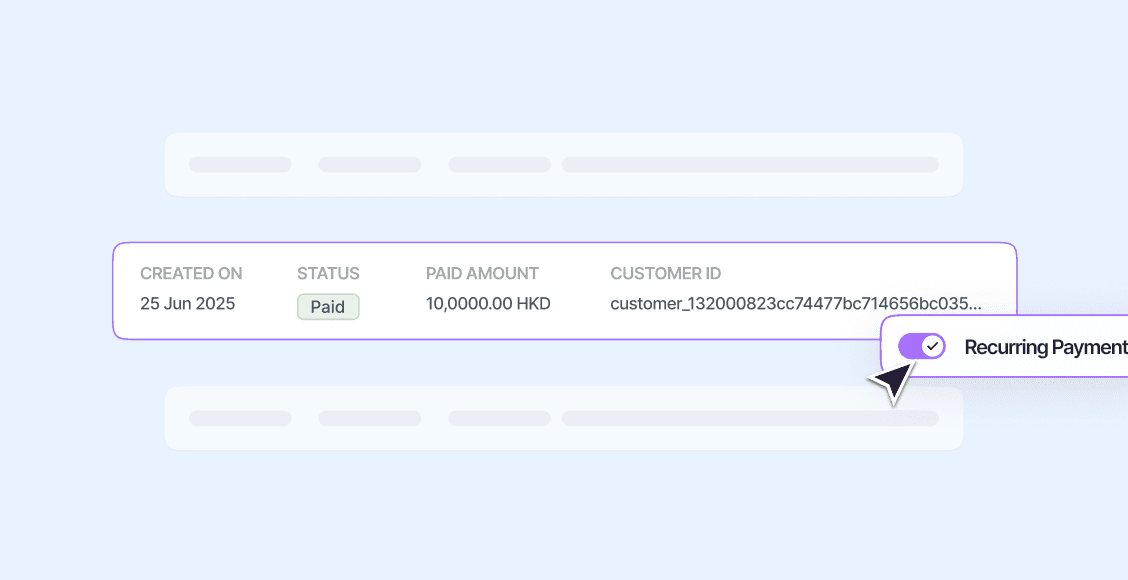

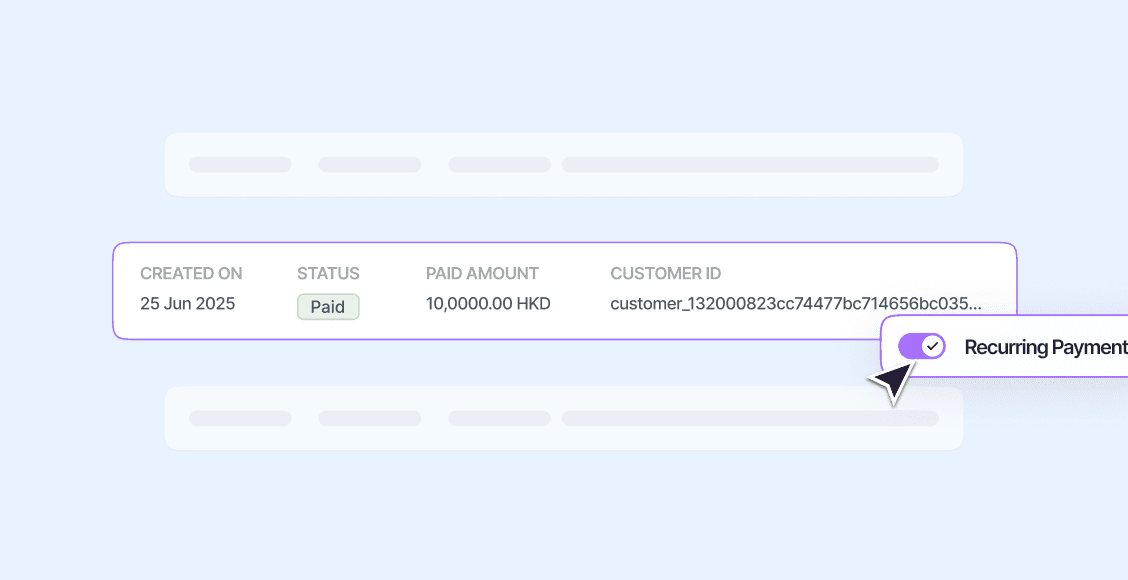

Cash management

Replace spreadsheets with structured workflows. Automate approvals, recurring payments, and real-time controls to ensure secure, error-free finance operations.

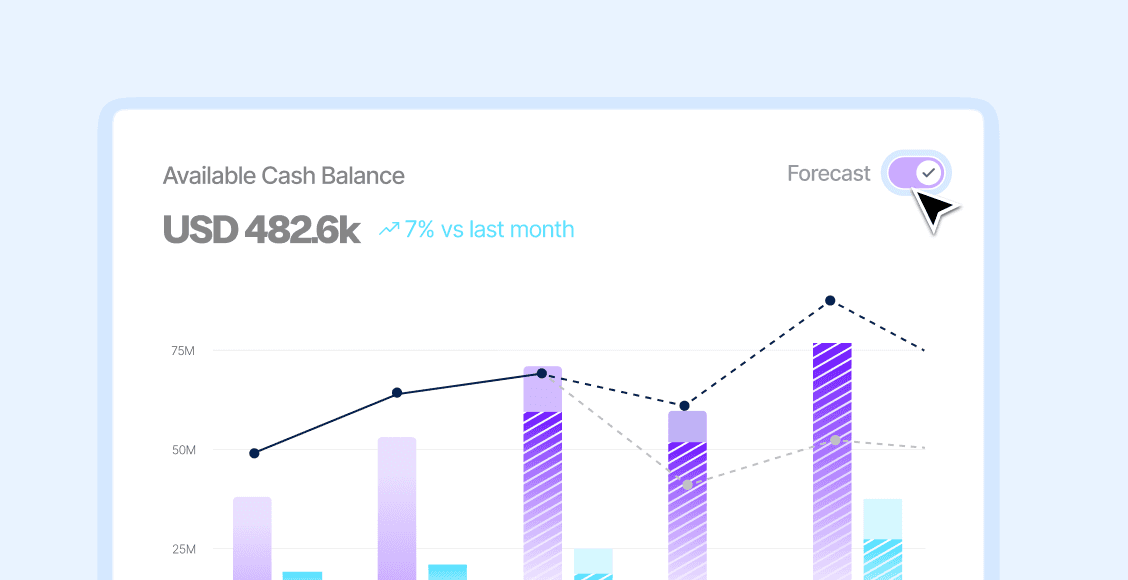

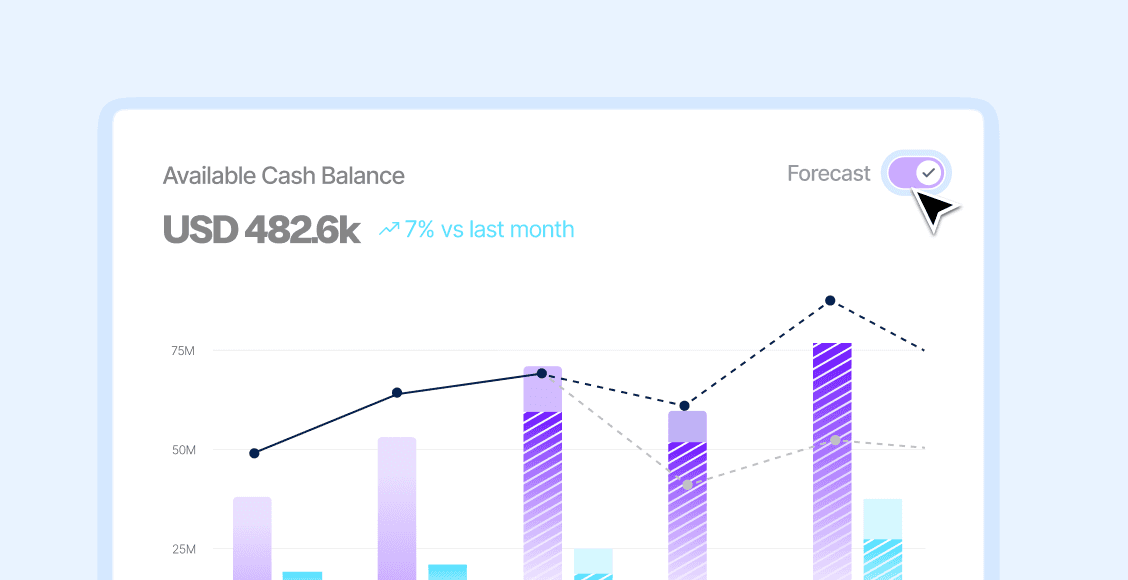

Forecasting & capital planning

Model scenarios, anticipate risks, and allocate capital with confidence. Finmo turns cashflow forecasting into a strategic growth engine for CFOs.

MO AI - Your Fin-Ops Co-Pilot

Instant insights at your fingertips. Ask questions like: “What’s my burn rate this quarter?” or “How much surplus cash can I invest next month?” and get instant, contextual answers. It’s like having a strategic fin-ops partner available 24/7 without adding headcount.

Feature / Capability

Finmo

Company-A

Company-B

End-to-end Treasury Management System

Real-Time Consolidated Cash Visibility (All Bank Accounts + Wallets)

Offers Bank Integrations (in Singapore only)

Payments

Real-Time Forecasting & Predictive Cashflow Modeling

Seamless ERP & Accounting System Integrations (Two-way sync)

Regulated Yield Products

MO AI Copilot (Conversational Interface, Intelligent Insights, Workflow Automation)

Cash & Liquidity Management

Real-time dashboards for multi-bank visibility, forecasting, AR/AP overlays, and liquidity optimization.

Limited treasury tools. Focus remains on multi-currency accounts and payments

AR/AP Workflows

Verified and trusted worldwide

1

Platform to run your treasury

235+

Payout Countries

40+

Pay in Currencies

15

Global banking partners

2000+

Bank Connections

$15bn+

Transactions processed in USD

Safe in our hands

We hold your money with leading global financial institutions. Your funds are always safeguarded in line with the local regulations where Finmo operates.

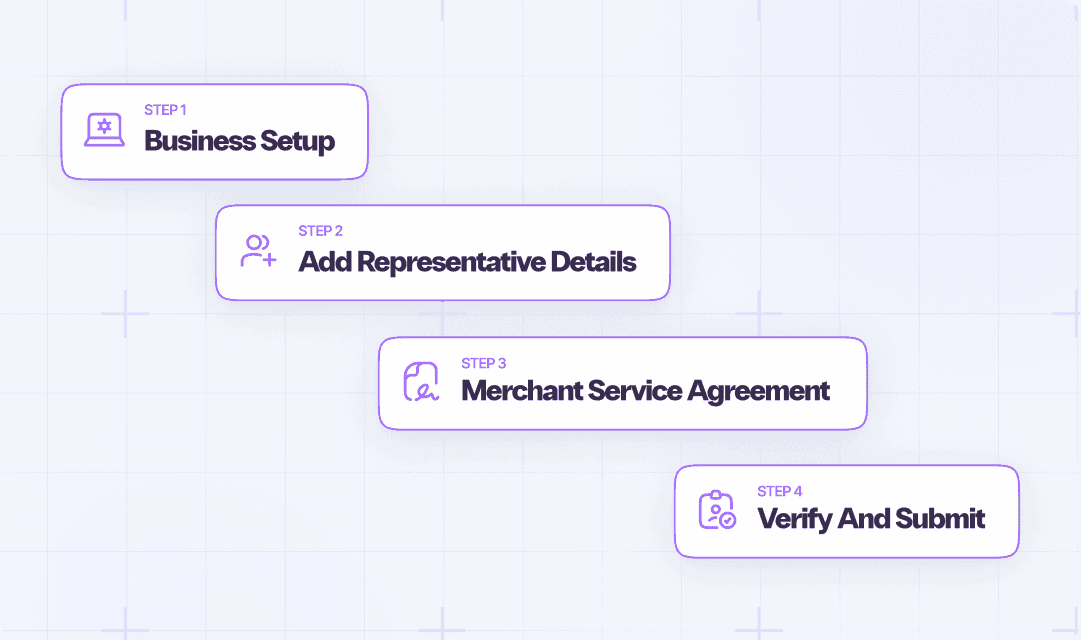

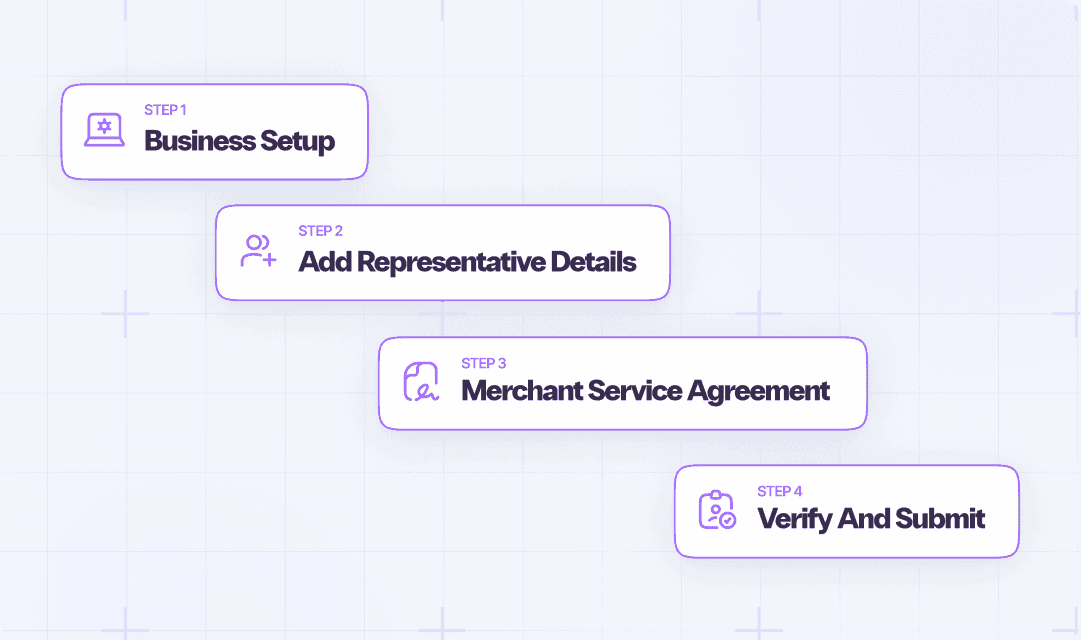

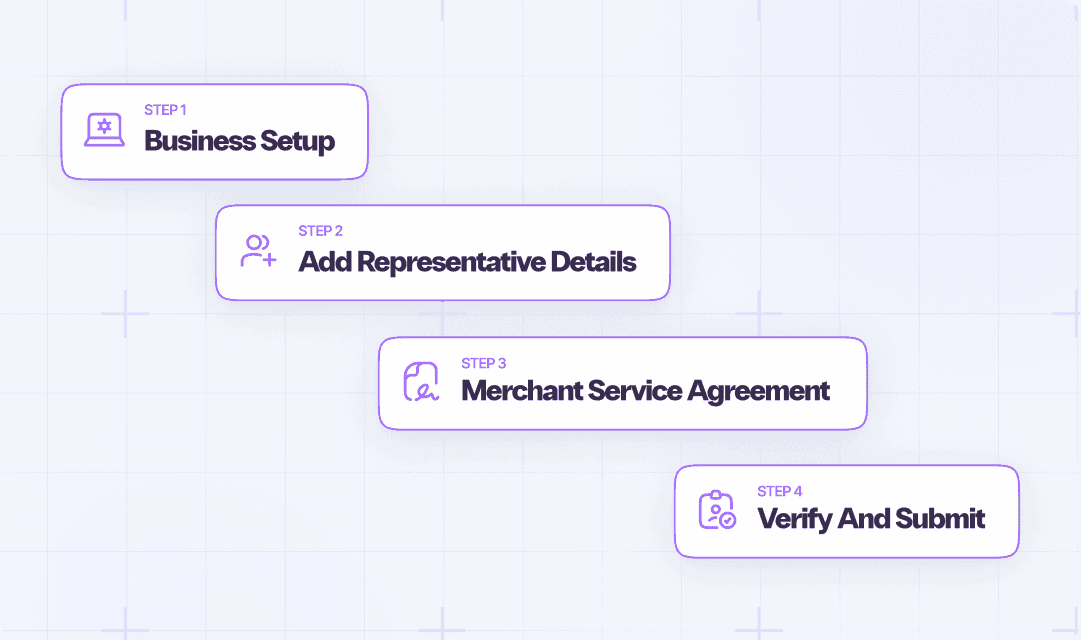

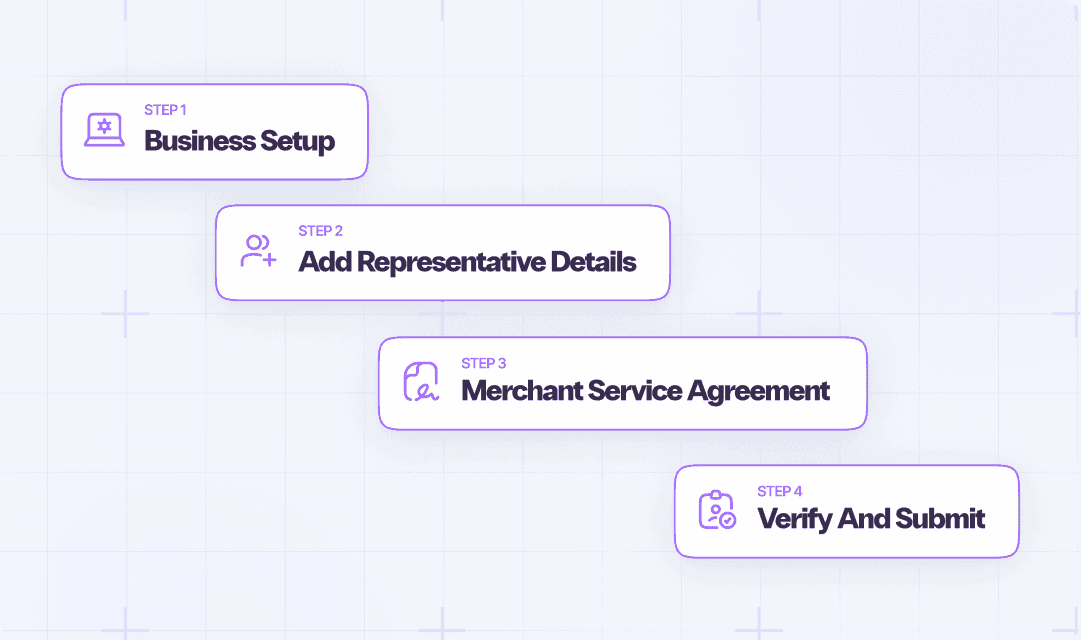

Onboard in Days, Not Months.

Our slick 4-step onboarding KYB process gets you up-and-running fast while removing unnecessary processes and paperwork.

Ways to integrate with us

White-Label Treasury Platform

Offer Finmo’s complete Treasury Operating System under your own brand. Maintain client relationships while leveraging Finmo’s infrastructure and shared revenue models, delivering competitive treasury services without years of internal build.

API Integration Partnership

Embed specific Finmo modules - money movement, cash management, FX risk management directly into your existing platform. Enhance your product suite with best-in-class treasury functionality through seamless APIs.

Co-Branded Solutions

Go to market together with shared branding, targeting enterprises that need modern treasury technology alongside existing workflows. Finmo provides operational infrastructure while partners drive distribution and customer success.

What our customers say about us

See how Finmo has helped businesses like yours in better management of their cash and treasury.

Finmo’s platform is outstanding and consistently improves through regular updates. The overall user experience is seamless, particularly during login and redirection processes, which operate efficiently. All functionalities are well-executed, and I am confident that the team will continue to refine and enhance the platform diligently.

Appharu Pte Ltd

From day one, Finmo has treated Auptimate as a valued partner, not just a client. As an early-stage startup, we needed a flexible solution, and they delivered—backed by a responsive, supportive team that truly cares about our success.

More than just exceptional service, Finmo actively listens to customer feedback, continuously improving their platform to drive innovation in payments and build a more seamless financial future.

Partnering with Finmo has enabled us to streamline our SPV treasury operations and access broader payment rails with ease. Their Finmo Earn and cash management visibility tools have brought greater control, transparency, and efficiency to how we manage funds across jurisdictions. It’s a game-changer for our SPV clients.

Olivier Too

CEO @ Auptimate

Finmo has been instrumental in helping Finiqly seamlessly onboard and integrate customers across Australia and New Zealand. Their advanced local rails enable us to streamline cross-border transactions efficiently, supporting a diverse range of businesses with reliable, real-time payment solutions. Working closely with the Finmo team, we've been able to deliver a superior experience for our clients, reducing onboarding time and enhancing overall payment agility.

Valeria

Head of Business Development

FAQ

Frequently asked questions

How quickly can I start using Finmo?

You can set up your account and start using Finmo within minutes - no lengthy onboarding.

Are there any hidden fees?

Will Finmo integrate with my existing tools?

What support do I get?

Finmo is the next-generation Treasury Operating System (TOS) for global companies built on real-time payments (RTP) rails. Finmo lets you collect money, make payments, manage cash and liquidity, mitigate financial risks, and comply with financial regulations – all in one place.

Any information provided on this website is for general information purposes only and does not take into account your objectives, financial situation or needs. Please consider our Financial Services Guide and Product Disclosure Statement and if the information is right for you before acquiring the product or service.

Finmo is the next-generation Treasury Operating System (TOS) for global companies built on real-time payments (RTP) rails. Finmo lets you collect money, make payments, manage cash and liquidity, mitigate financial risks, and comply with financial regulations – all in one place.

Any information provided on this website is for general information purposes only and does not take into account your objectives, financial situation or needs. Please consider our Financial Services Guide and Product Disclosure Statement and if the information is right for you before acquiring the product or service.

Finmo is the next-generation Treasury Operating System (TOS) for global companies built on real-time payments (RTP) rails. Finmo lets you collect money, make payments, manage cash and liquidity, mitigate financial risks, and comply with financial regulations – all in one place.

Any information provided on this website is for general information purposes only and does not take into account your objectives, financial situation or needs. Please consider our Financial Services Guide and Product Disclosure Statement and if the information is right for you before acquiring the product or service.

Connected financial intelligence and control for tomorrow’s CFO

Finmo turns disparate financial data across your business into connected, future-facing intelligence, and act on it with speed and confidence.

Treasury management for mid-market CFOs

Deep realtime global payment network

Integrations across bank accounts, ERPs and Accounting Softwares

The challenge

How Finmo solves it

Cash Management Blind Spots

Finance teams lack real-time visibility into balances across banks, entities, and currencies. Liquidity remains fragmented, slowing decision-making

Real-time cash visibility

Connect directly with banking partners to stream bank statement data in real time. CFOs gain instant, consolidated visibility into cash positions across the business.

Working Capital Constraints

Idle balances and trapped receivables/payables limit growth and prevent CFOs from deploying capital strategically.

Liquidity Management

Forecasting and scenario planning help CFOs optimize working capital, unlock liquidity, and redeploy capital to fuel growth.

Payment Fragmentation

Managing AR/AP globally requires multiple integrations with different providers, driving complexity and maintenance overhead.

Orchestrate commercial payments, both collect in 40 currencies and send money to 180+ currencies with Finmo’s global payment network without the burden of managing individual integrations.

FX Risk & Margin Leakage

Multi-currency transactions expose businesses to volatility, hidden spreads, and settlement delays that quietly eat into margins.

Leverage Finmo’s global payment network and built-in FX intelligence to cut intermediary costs, hedge exposures, and protect margins.

Strategic Decisions

CFOs struggle to act on data when planning investments or managing runway. Data compilation takes forever, leaving little time for actual decision-making.

Consolidate bank balances across entities and currencies, along with receivables and payables data, to gain full visibility into your cash position.

Product

Real-time cash visibility

Get a 360° view of global cash positions across all bank accounts, entities, currencies and investments, giving finance leaders the clarity to act faster.

Global payments & FX

Streamline international transactions with a global payments infrastructure. Collect payments in 40+ currencies, pay out to 180+ countries, and settle faster through 15+ banking partners. FX is built in so you protect margins and cut conversion costs as you scale.

Cash management

Replace spreadsheets with structured workflows. Automate approvals, recurring payments, and real-time controls to ensure secure, error-free finance operations.

Forecasting & capital planning

Model scenarios, anticipate risks, and allocate capital with confidence. Finmo turns cashflow forecasting into a strategic growth engine for CFOs.

MO AI - Your Fin-Ops Co-Pilot

Instant insights at your fingertips. Ask questions like: “What’s my burn rate this quarter?” or “How much surplus cash can I invest next month?” and get instant, contextual answers. It’s like having a strategic fin-ops partner available 24/7 without adding headcount.

Feature / Capability

Finmo

Company-A

Company-B

End-to-end Treasury Management System

Real-Time Consolidated Cash Visibility (All Bank Accounts + Wallets)

Offers Bank Integrations (in Singapore only)

Payments

Real-Time Forecasting & Predictive Cashflow Modeling

Seamless ERP & Accounting System Integrations (Two-way sync)

Regulated Yield Products

MO AI Copilot (Conversational Interface, Intelligent Insights, Workflow Automation)

Cash & Liquidity Management

Real-time dashboards for multi-bank visibility, forecasting, AR/AP overlays, and liquidity optimization.

Limited treasury tools. Focus remains on multi-currency accounts and payments

AR/AP Workflows

Verified and trusted worldwide

1

Platform to run your treasury

235+

Payout Countries

40+

Pay in Currencies

15

Global banking partners

2000+

Bank Connections

$15bn+

Transactions processed in USD

Safe in our hands

We hold your money with leading global financial institutions. Your funds are always safeguarded in line with the local regulations where Finmo operates.

Onboard in Days, Not Months.

Our slick 4-step onboarding KYB process gets you up-and-running fast while removing unnecessary processes and paperwork.

Ways to integrate with us

White-Label Treasury Platform

Offer Finmo’s complete Treasury Operating System under your own brand. Maintain client relationships while leveraging Finmo’s infrastructure and shared revenue models, delivering competitive treasury services without years of internal build.

API Integration Partnership

Embed specific Finmo modules - money movement, cash management, FX risk management directly into your existing platform. Enhance your product suite with best-in-class treasury functionality through seamless APIs.

Co-Branded Solutions

Go to market together with shared branding, targeting enterprises that need modern treasury technology alongside existing workflows. Finmo provides operational infrastructure while partners drive distribution and customer success.

What our customers say about us

See how Finmo has helped businesses like yours in better management of their cash and treasury.

Finmo’s platform is outstanding and consistently improves through regular updates. The overall user experience is seamless, particularly during login and redirection processes, which operate efficiently. All functionalities are well-executed, and I am confident that the team will continue to refine and enhance the platform diligently.

Appharu Pte Ltd

From day one, Finmo has treated Auptimate as a valued partner, not just a client. As an early-stage startup, we needed a flexible solution, and they delivered—backed by a responsive, supportive team that truly cares about our success.

More than just exceptional service, Finmo actively listens to customer feedback, continuously improving their platform to drive innovation in payments and build a more seamless financial future.

Partnering with Finmo has enabled us to streamline our SPV treasury operations and access broader payment rails with ease. Their Finmo Earn and cash management visibility tools have brought greater control, transparency, and efficiency to how we manage funds across jurisdictions. It’s a game-changer for our SPV clients.

Olivier Too

CEO @ Auptimate

Finmo has been instrumental in helping Finiqly seamlessly onboard and integrate customers across Australia and New Zealand. Their advanced local rails enable us to streamline cross-border transactions efficiently, supporting a diverse range of businesses with reliable, real-time payment solutions. Working closely with the Finmo team, we've been able to deliver a superior experience for our clients, reducing onboarding time and enhancing overall payment agility.

Valeria

Head of Business Development

Finmo’s platform is outstanding and consistently improves through regular updates. The overall user experience is seamless, particularly during login and redirection processes, which operate efficiently. All functionalities are well-executed, and I am confident that the team will continue to refine and enhance the platform diligently.

Appharu Pte Ltd

From day one, Finmo has treated Auptimate as a valued partner, not just a client. As an early-stage startup, we needed a flexible solution, and they delivered—backed by a responsive, supportive team that truly cares about our success.

More than just exceptional service, Finmo actively listens to customer feedback, continuously improving their platform to drive innovation in payments and build a more seamless financial future.

Partnering with Finmo has enabled us to streamline our SPV treasury operations and access broader payment rails with ease. Their Finmo Earn and cash management visibility tools have brought greater control, transparency, and efficiency to how we manage funds across jurisdictions. It’s a game-changer for our SPV clients.

Olivier Too

CEO @ Auptimate

Finmo has been instrumental in helping Finiqly seamlessly onboard and integrate customers across Australia and New Zealand. Their advanced local rails enable us to streamline cross-border transactions efficiently, supporting a diverse range of businesses with reliable, real-time payment solutions. Working closely with the Finmo team, we've been able to deliver a superior experience for our clients, reducing onboarding time and enhancing overall payment agility.

Valeria

Head of Business Development

FAQ

Frequently asked questions

FAQ

Frequently asked questions

How quickly can I start using Finmo?

You can set up your account and start using Finmo within minutes - no lengthy onboarding.

Are there any hidden fees?

Will Finmo integrate with my existing tools?

What support do I get?

How quickly can I start using Finmo?

You can set up your account and start using Finmo within minutes - no lengthy onboarding.

Are there any hidden fees?

Will Finmo integrate with my existing tools?

What support do I get?

Connected financial intelligence and control for tomorrow’s CFO

Finmo turns disparate financial data across your business into connected, future-facing intelligence, and act on it with speed and confidence.

Treasury management for mid-market CFOs

Deep realtime global payment network

Integrations across bank accounts, ERPs and Accounting Softwares

The challenge

Cash Management Blind Spots

Finance teams lack real-time visibility into balances across banks, entities, and currencies. Liquidity remains fragmented, slowing decision-making

Working Capital Constraints

Idle balances and trapped receivables/payables limit growth and prevent CFOs from deploying capital strategically.

Payment Fragmentation

Managing AR/AP globally requires multiple integrations with different providers, driving complexity and maintenance overhead.

FX Risk & Margin Leakage

Multi-currency transactions expose businesses to volatility, hidden spreads, and settlement delays that quietly eat into margins.

Strategic Decisions

CFOs struggle to act on data when planning investments or managing runway. Data compilation takes forever, leaving little time for actual decision-making.

How Finmo Solves It

Real-time cash visibility

Connect directly with banking partners to stream bank statement data in real time. CFOs gain instant, consolidated visibility into cash positions across the business.

Liquidity Management

Forecasting and scenario planning help CFOs optimize working capital, unlock liquidity, and redeploy capital to fuel growth.

Orchestrate commercial payments, both collect in 40 currencies and send money to 180+ currencies with Finmo’s global payment network without the burden of managing individual integrations.

Consolidate bank balances across entities and currencies, along with receivables and payables data, to gain full visibility into your cash position.

Leverage Finmo’s global payment network and built-in FX intelligence to cut intermediary costs, hedge exposures, and protect margins.

Product

Real-time cash visibility

Get a 360° view of global cash positions across all bank accounts, entities, currencies and investments, giving finance leaders the clarity to act faster.

Global payments & FX

Streamline international transactions with a global payments infrastructure. Collect payments in 40+ currencies, pay out to 180+ countries, and settle faster through 15+ banking partners. FX is built in so you protect margins and cut conversion costs as you scale.

Cash management

Replace spreadsheets with structured workflows. Automate approvals, recurring payments, and real-time controls to ensure secure, error-free finance operations.

Forecasting & capital planning

Model scenarios, anticipate risks, and allocate capital with confidence. Finmo turns cashflow forecasting into a strategic growth engine for CFOs.

MO AI - Your Fin-Ops Co-Pilot

Instant insights at your fingertips. Ask questions like: “What’s my burn rate this quarter?” or “How much surplus cash can I invest next month?” and get instant, contextual answers. It’s like having a strategic fin-ops partner available 24/7 without adding headcount.

Feature / Capability

Finmo

Company-A

Company-B

End-to-end Treasury Management System

Real-Time Consolidated Cash Visibility (All Bank Accounts + Wallets)

Offers Bank Integrations (in Singapore only)

Payments

Real-Time Forecasting & Predictive Cashflow Modeling

Seamless ERP & Accounting System Integrations (Two-way sync)

Regulated Yield Products

MO AI Copilot (Conversational Interface, Intelligent Insights, Workflow Automation)

Cash & Liquidity Management

Real-time dashboards for multi-bank visibility, forecasting, AR/AP overlays, and liquidity optimization.

Limited treasury tools. Focus remains on multi-currency accounts and payments

AR/AP Workflows

Verified and trusted worldwide

1

Platform to run your treasury

235+

Payout Countries

40+

Pay in Currencies

15

Global banking partners

2000+

Bank Connections

$15bn+

Transactions processed in USD

Safe in our hands

We hold your money with leading global financial institutions. Your funds are always safeguarded in line with the local regulations where Finmo operates.

Onboard in Days, Not Months.

Our slick 4-step onboarding KYB process gets you up-and-running fast while removing unnecessary processes and paperwork.

Ways to integrate with us

White-Label Treasury Platform

Offer Finmo’s complete Treasury Operating System under your own brand. Maintain client relationships while leveraging Finmo’s infrastructure and shared revenue models, delivering competitive treasury services without years of internal build.

API Integration Partnership

Embed specific Finmo modules - money movement, cash management, FX risk management directly into your existing platform. Enhance your product suite with best-in-class treasury functionality through seamless APIs.

Co-Branded Solutions

Go to market together with shared branding, targeting enterprises that need modern treasury technology alongside existing workflows. Finmo provides operational infrastructure while partners drive distribution and customer success.

What our customers say about us

See how Finmo has helped businesses like yours in better management of their cash and treasury.

Finmo’s platform is outstanding and consistently improves through regular updates. The overall user experience is seamless, particularly during login and redirection processes, which operate efficiently. All functionalities are well-executed, and I am confident that the team will continue to refine and enhance the platform diligently.

Appharu Pte Ltd

From day one, Finmo has treated Auptimate as a valued partner, not just a client. As an early-stage startup, we needed a flexible solution, and they delivered—backed by a responsive, supportive team that truly cares about our success.

More than just exceptional service, Finmo actively listens to customer feedback, continuously improving their platform to drive innovation in payments and build a more seamless financial future.

Partnering with Finmo has enabled us to streamline our SPV treasury operations and access broader payment rails with ease. Their Finmo Earn and cash management visibility tools have brought greater control, transparency, and efficiency to how we manage funds across jurisdictions. It’s a game-changer for our SPV clients.

Olivier Too

CEO @ Auptimate

Finmo has been instrumental in helping Finiqly seamlessly onboard and integrate customers across Australia and New Zealand. Their advanced local rails enable us to streamline cross-border transactions efficiently, supporting a diverse range of businesses with reliable, real-time payment solutions. Working closely with the Finmo team, we've been able to deliver a superior experience for our clients, reducing onboarding time and enhancing overall payment agility.

Valeria

Head of Business Development

Finmo’s platform is outstanding and consistently improves through regular updates. The overall user experience is seamless, particularly during login and redirection processes, which operate efficiently. All functionalities are well-executed, and I am confident that the team will continue to refine and enhance the platform diligently.

Appharu Pte Ltd

From day one, Finmo has treated Auptimate as a valued partner, not just a client. As an early-stage startup, we needed a flexible solution, and they delivered—backed by a responsive, supportive team that truly cares about our success.

More than just exceptional service, Finmo actively listens to customer feedback, continuously improving their platform to drive innovation in payments and build a more seamless financial future.

Partnering with Finmo has enabled us to streamline our SPV treasury operations and access broader payment rails with ease. Their Finmo Earn and cash management visibility tools have brought greater control, transparency, and efficiency to how we manage funds across jurisdictions. It’s a game-changer for our SPV clients.

Olivier Too

CEO @ Auptimate

Finmo has been instrumental in helping Finiqly seamlessly onboard and integrate customers across Australia and New Zealand. Their advanced local rails enable us to streamline cross-border transactions efficiently, supporting a diverse range of businesses with reliable, real-time payment solutions. Working closely with the Finmo team, we've been able to deliver a superior experience for our clients, reducing onboarding time and enhancing overall payment agility.

Valeria

Head of Business Development

FAQ

Frequently asked questions

FAQ

Frequently asked questions

How quickly can I start using Finmo?

You can set up your account and start using Finmo within minutes - no lengthy onboarding.

Are there any hidden fees?

Will Finmo integrate with my existing tools?

What support do I get?

How quickly can I start using Finmo?

You can set up your account and start using Finmo within minutes - no lengthy onboarding.

Are there any hidden fees?

Will Finmo integrate with my existing tools?

What support do I get?