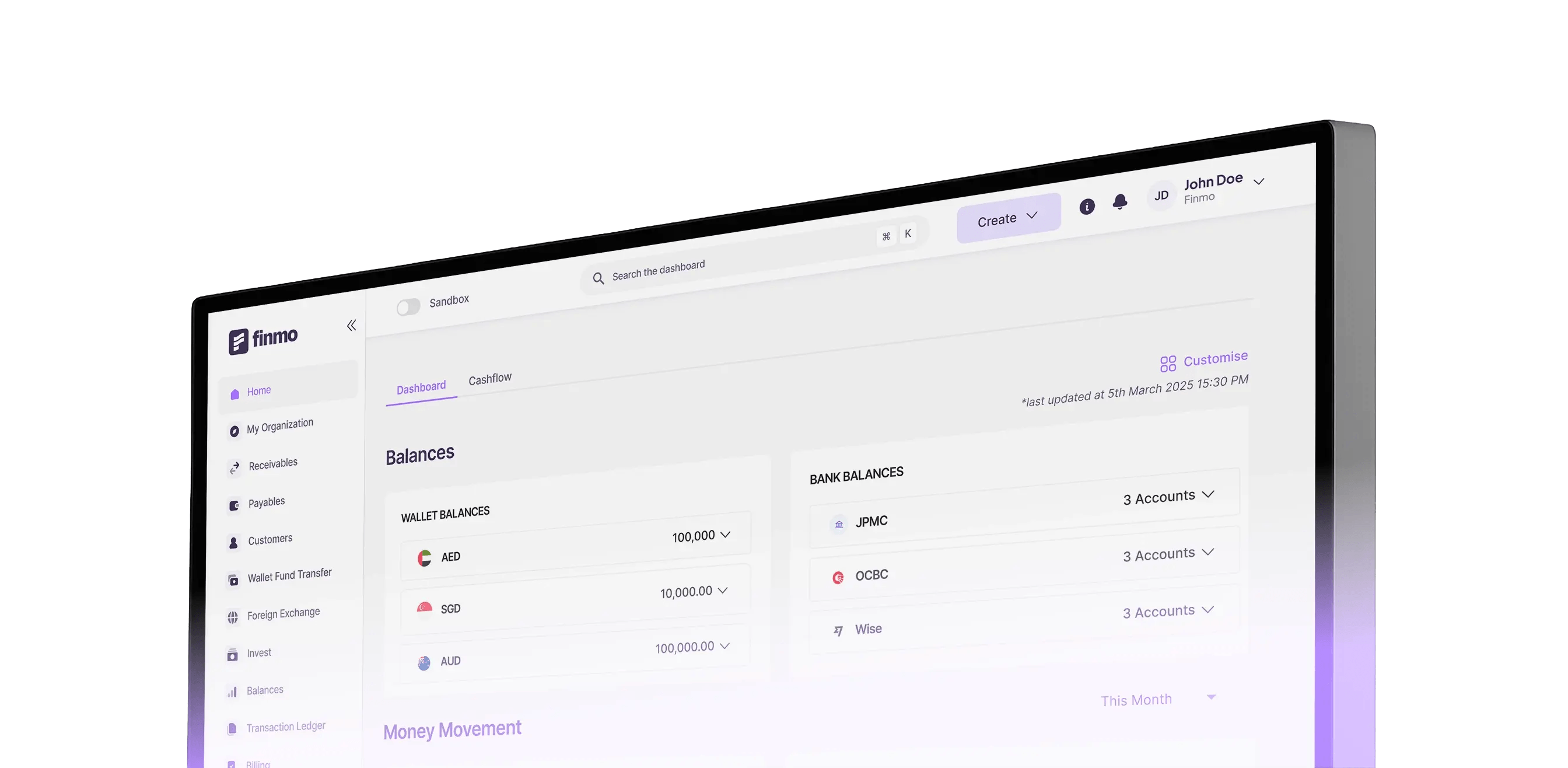

Treasury management for modern finance teams

Finmo is a treasury management and payment platform for modern finance teams. Integrate complete financial and bank data, move money globally,

optimise liquidity, and manage FX risk – all in one smart platform.

Future‑facing finance

Faced with the challenge of multiple geographies, currencies, entities and

compliance requirements, the demands on today’s CFO have never been greater.

With change the only constant, and complexity increasing, CFOs need to move from spreadsheet-based financial stewardship, to future-facing strategic leadership. But with finance teams held back by slow, disparate data, and multiple disconnected softwares, getting the future-facing visibility to do this isn’t easy.

At Finmo we provide agile treasury management that meets the needs of the modern CFO – without the expense and complexity of traditional enterprise solutions. A single platform that gives CFOs connected, future-facing intelligence, using data from across their business:

The foresight to know their next move.

And the confidence and control to act on it.

“Finance leadership today is about foresight. At Finmo, we empower CFOs to look beyond the numbers: to anticipate change, uncover opportunity, and scale their vision across markets with clarity and control”

Our expert team

Our executive team has over 100 years combined experience launching and leading globally recognised fintech, payments and compliance companies.

Join Finmo

Work with us to help shape the future of financial management for business.

Backed by the best

Contact us

Please get in touch for more information about our product, to discuss partnerships, or to speak to our PR or marketing team.