Back to blogs

Every creator platform promises the same thing: a way for people to share their work, grow their audience, and get paid fairly for it. From Substack newsletters to Patreon memberships, creator payouts are the backbone of these ecosystems.

Yet, as the creator economy expands, now valued at over $100 billion with over 50 million creators worldwide, the financial processes underneath are barely keeping up.

Hundreds of microtransactions flow in from fans and thousands of payouts go out to creators every month– all of which have to be tracked, converted into the right currencies, and reconciled perfectly. Even the smallest mistakes or delays can lead to major payment issues.

In this blog, we look behind the curtain to understand what really causes payout bottlenecks on creator marketplaces–and how Finmo helps fix all of those challenges and streamline global multi-currency payments.

The invisible stress of paying creators at scale

Followers pay in their own currencies; creators want to be paid in theirs. Somewhere in between, the platform must manage conversions, fees, regulations, and timing.

And while these may look easy to manage when you are just starting out and only have a few hundred influencers on board, the problem really starts when you start scaling your creator base faster than your payout systems can handle.

Every new step introduces new risks and complexities at scale

High transaction volumes

Instead of sending 50 payments a month, you’re processing 5,000–all with different payout structures, commission tiers, and schedules.

Global complications

Every country follows different banking rules and cut-off times. Some regions rely on local clearing systems; others require SWIFT or wire transfers that take days. Of course, you are also required to ensure compliance in every region you operate in.

Currency conversion

When you’re moving money across borders, every conversion costs you. Unfavorable FX rates or hidden transfer fees can quietly eat into your platform’s margins and even reduce what creators take home.

Liquidity management

You need to make sure there’s enough cash to fund payouts, even when revenues fluctuate. Locking too much in your payout accounts ties up capital you could be using to grow.

Finance teams stuck in reactive mode

Every scaling platform eventually hits the same wall: your finance team spends more time fixing payouts than forecasting growth. They’re chasing down failed transfers, reconciling transactions across different systems, and manually preparing reports for tax and compliance audits. All of that effort comes at the cost of missed opportunities.

Revenue and margin erosion

Payout friction also eats into your profit margins. Each time you process a cross-border payment manually without a strategic plan in place, you end up paying more in banking fees, wire charges, and FX spreads than you realize.

A recent survey found that 90% of creators have experienced issues getting paid, and 41% have even increased their rates to make up for late or inaccurate payments.

So when payouts break down, the impact goes far beyond your finance department. In other words, payout inefficiency doesn’t just drain revenue. It puts a ceiling on your growth.

Why platforms outgrow manual and legacy financial systems

Manual reconciliation, siloed systems, and patchwork compliance tools might get you through the early stages, but they don’t scale.

The problem is structural: most finance teams managing marketplace platforms start with disjointed systems with separate tools for payments, FX, accounting, and compliance. Each tool solves a small part of the puzzle, but none of them offer full visibility or control.

As your creator network scales

Finance teams manage more currencies, more bank accounts, and more compliance layers

Every payout cycle involves repetitive manual tasks

Data lives in silos, making it hard to forecast liquidity or reconcile accounts accurately

Without real-time visibility into cash flow, compliance, and payouts, you’re consistently relying on outdated data. By the time your reports are consolidated, transactions have already moved, FX rates have shifted, and new payout requests have come in. It's a cycle that keeps repeating–unless you can find a way to break it.

Finmo: The smarter way to scale creator payouts

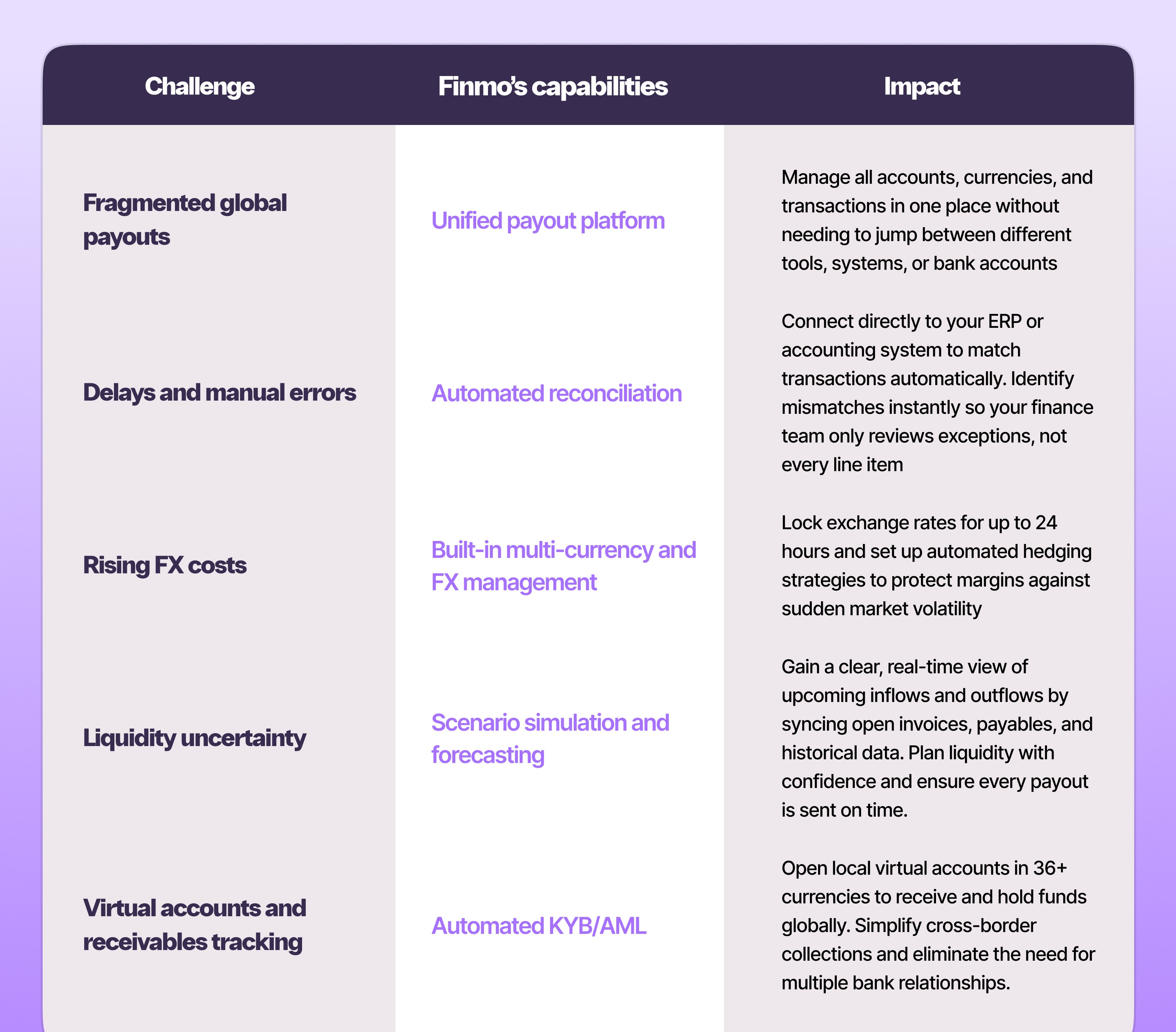

Finmo acts as a Treasury Operating System for global platforms, combining payments, reconciliation, liquidity management, and compliance into one intelligent infrastructure. It helps you manage all your incoming and outgoing payouts across every currency, creator, and geography from a single, unified dashboard.

Here’s how it changes the game for creator marketplaces dealing with payment bottlenecks:

The future of creator payouts

As payment networks, currencies, and regulations become more fragmented, creator platforms have a choice: keep patching together outdated systems or build a strong financial foundation that can grow with them.

The platforms that lead the next wave of the creator economy will be the ones that manage money as easily as they manage content.

Finmo helps you do exactly that, by giving you a single system to manage global payouts, track liquidity, and pay creators accurately, every time.