From idle cash to active returns

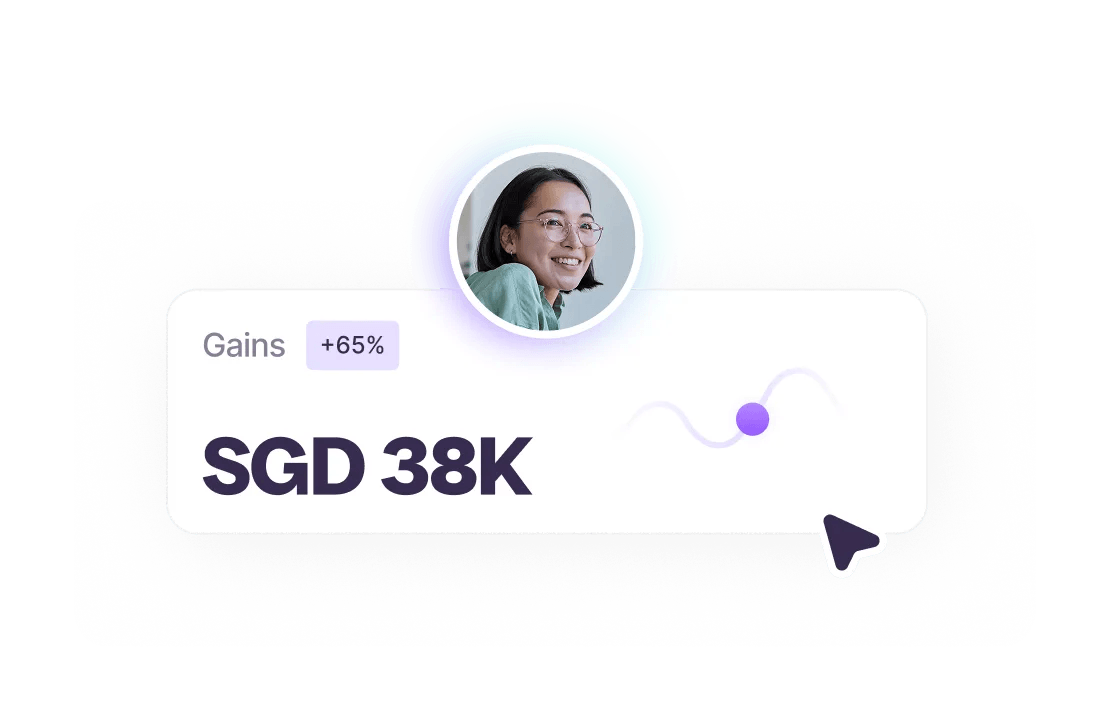

Get idle cash working for you. Invest in low-risk, easy-access money market funds to build returns and beat inflation.

Put your cash to work

Make the most of excess capital using our smart investment funds.

Put your cash to work with our smart investment opportunities and potentially earn up to ~4+% in projected returns.* With unlimited transfers, no minimum balances and no lock-in period.

Rising inflation can erode your reserves. Protect your business’s capital by earning competitive returns – and see off inflationary pressures.

Enjoy simple and seamless fund management, integrated within Finmo’s intuitive platform. Easily invest and monitor daily returns and balances across all currencies in one simple dashboard.

Need your funds? Simply withdraw with 2-4 business days settlement. Track your transfers in real-time and access your investments anytime.

Your assets are held securely with leading financial institutions. All deposits are protected by bank-grade security and risk controls.

Ready‑made investments

We partner with award-winning advisors Endowus and Syfe to help you earn competitive returns.

Invest with Endowus

Get started in three simple steps

Terms and conditions Finmo acts as an introducer to ENDOWUS SINGAPORE PTE. LTD. ("Endowus") and SYFE PTE. LTD. ("Syfe"). In return for introducing clients to Endowus and Syfe, Finmo receives a revenue share. Endowus is a Capital Markets Services (CMS) Licence holder by the Monetary Authority of Singapore under the Securities and Futures Act (Chapter 289) of Singapore ("SFA") (CMS License 101051) and an exempt financial advisor under the Financial Advisors Act (Chapter 110) of Singapore to provide certain financial advisory services. Syfe is regulated by the Monetary Authority of Singapore and holds Capital Markets Services Licence No. CMS100837.

The full suite of investment options (including Fixed Income, Equities, Multi-Asset and Alternative Investment Funds) may also available to you through Endowus. By using the Finmo Dashboard to view your investment holdings on Endowus, you consent to Endowus Singapore Pte Ltd disclosing information about your account to Finmo Tech Pte Ltd.

Assets safely held with UOB Kay Hian

Your company’s cash and investments are held in your own legal name with UOB Kay Hian, one of Asia's largest brokerage firms.

Your assets are never commingled with Endowus or other entities’ assets.

*Not guaranteed. Projected yields calculated as of 7 October 2025. Yields are net of Fund-level fee and Endowus fee.

Try Finmo’s treasury dashboard today

Sign up to explore our dashboard for yourself. Or book a demo to talk things through with our team.