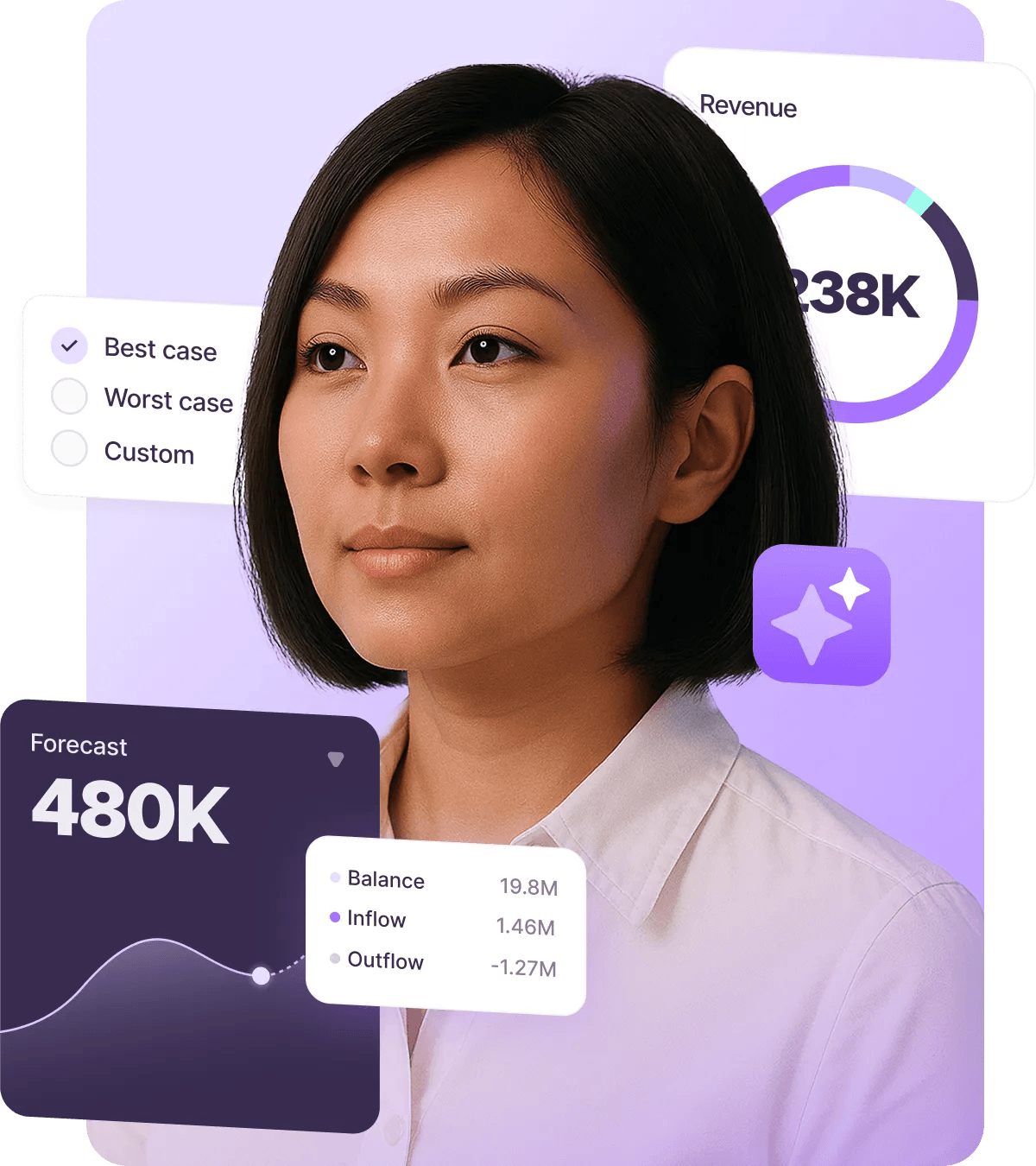

Take command of cash flow with automated forecasting

Automate real-time cash flow projections across accounts and entities. Replace spreadsheets with a unified liquidity view and empower your leadership with data needed for smarter, faster decisions.

Make data‑backed cash flow decisions

Scale smoothly and make future calls with confidence on our cash forecasting software, featuring comprehensive up-to-the minute financial data across subsidiaries and entities.

Define forecasting hierarchies by entity, subsidiary, currency, or account. Select exactly which wallets and bank accounts to include in your consolidated liquidity view.

Forecast cash positions daily, weekly, monthly, or quarterly. Adjust scenarios to model best-case, worst-case, or custom liquidity assumptions.

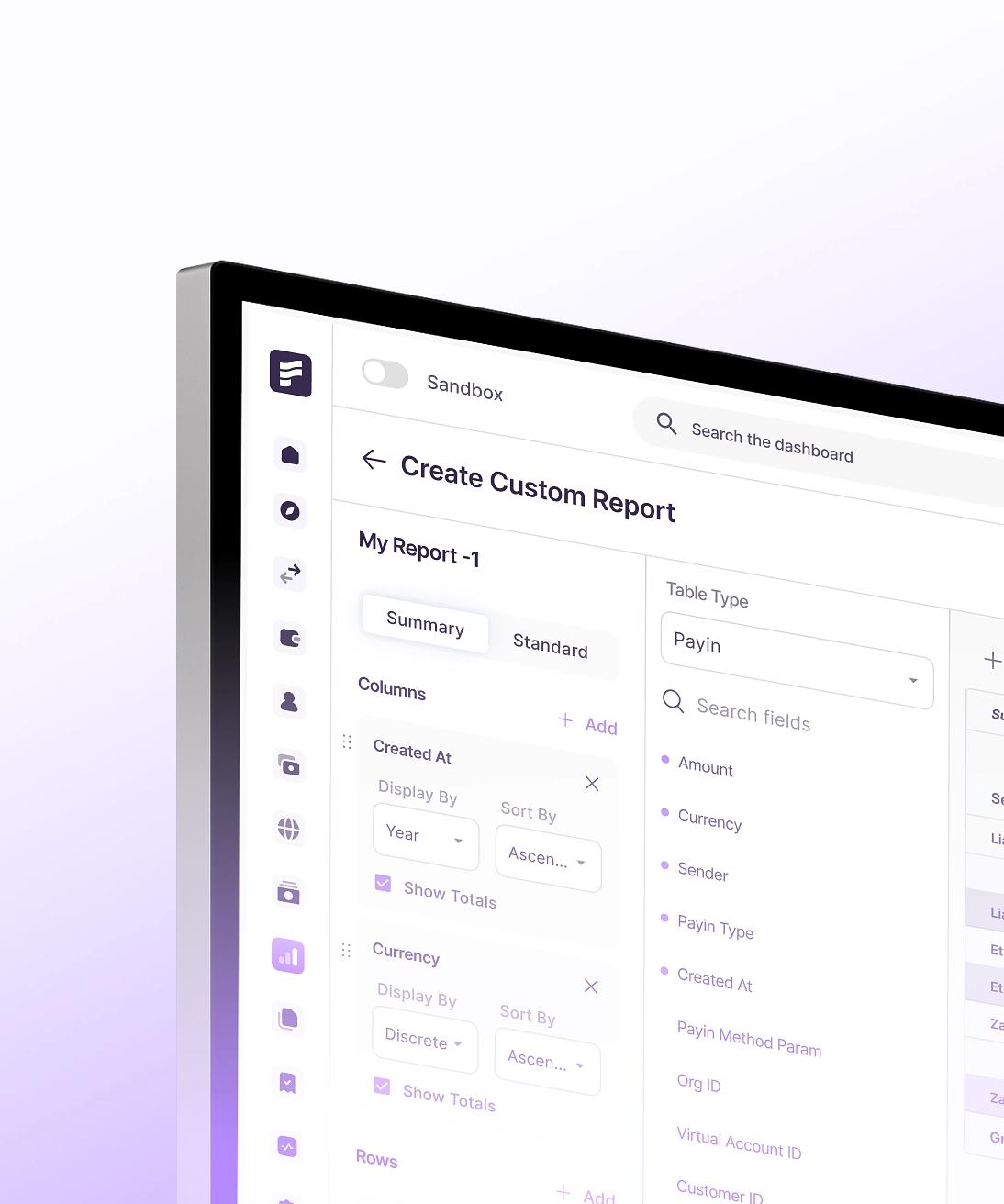

Excel, without Excel

Stop struggling with spreadsheets. Finmo centralizes your financial data to give you a consolidated view of your cash flow in one place. Analyse your data with precision, create custom forecasts instantly, and free yourself from repetitive tasks for good.

Financial foresight

Maintain healthy cash flow. Proactively model, forecast and plan your future working capital position by dynamically analysing your historical payment patterns.

Instantly spot potential surpluses or shortfalls with projection software and decisively optimize liquidity or mitigate FX risk.

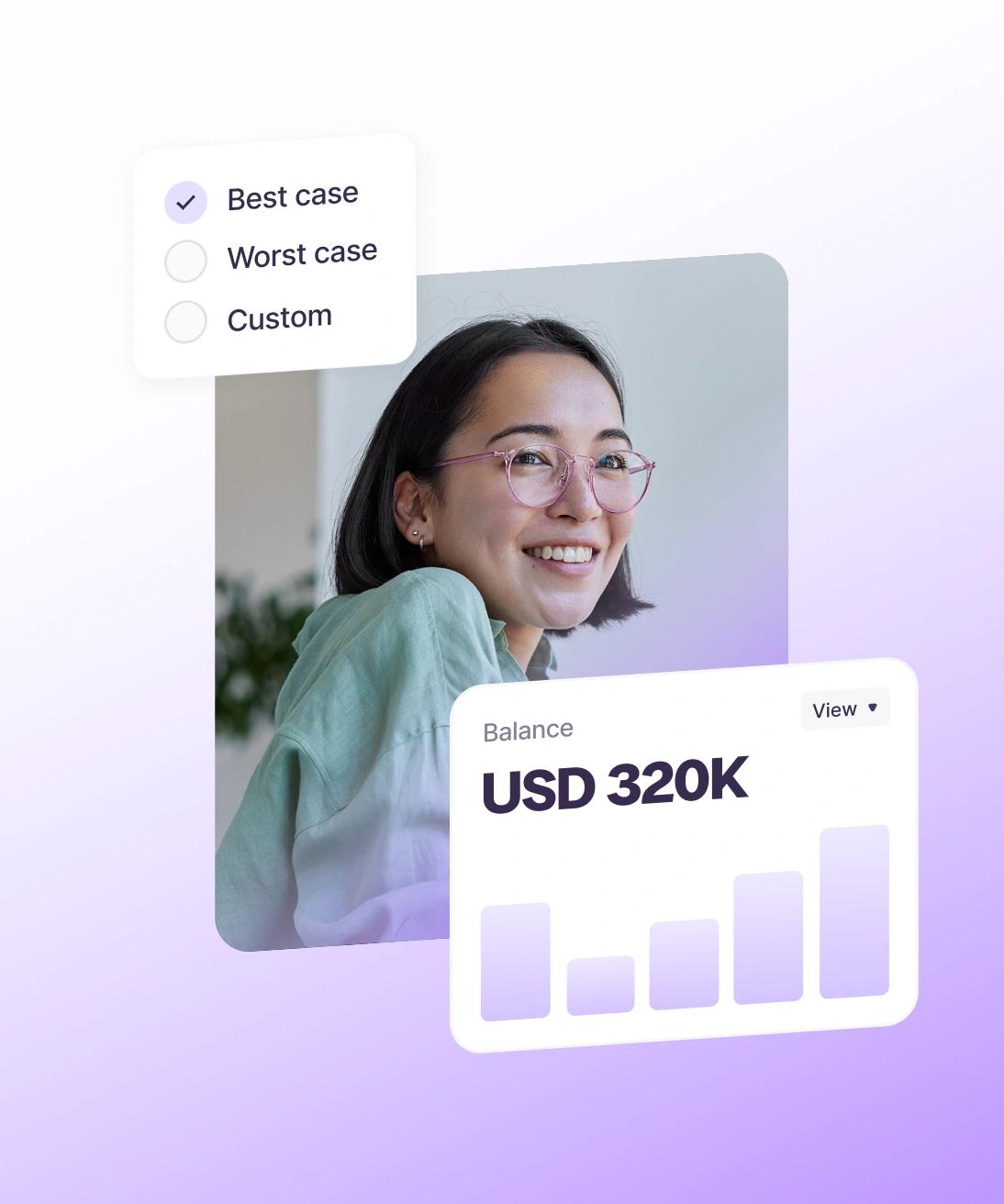

Expect the unexpected

Test what-if cases like delayed payments, unexpected expenses, or accelerated revenues, and instantly see their impact on your cash flow. Quickly toggle between multiple scenarios to compare outcomes side-by-side and make informed decisions faster.

Financial reporting, simplified.

Generate presentation-ready cash flow reports using historical data, real-time forecasts, and scenario projections. Create custom liquidity and working capital reports to share with leadership, boards, and stakeholders

Keep every transaction at your fingertips

Be audit-ready in an instant. All transactions are recorded in a single immutable ledger, to give you accurate and easily accessible financial records.

Make payments smarter

Collect in 40+ currencies and pay-out in 200+ countries – with instant FX.

Try Finmo’s treasury dashboard today

Sign up to explore our spreadsheet-free cash flow forecasting dashboard firsthand.

Book a demo to talk to our team.