A Clear View of Cash

Make more confident cash flow decisions with up-to-the-minute visibility into your cash positions, forecasts, and liquidity.all without manual reconciliations.

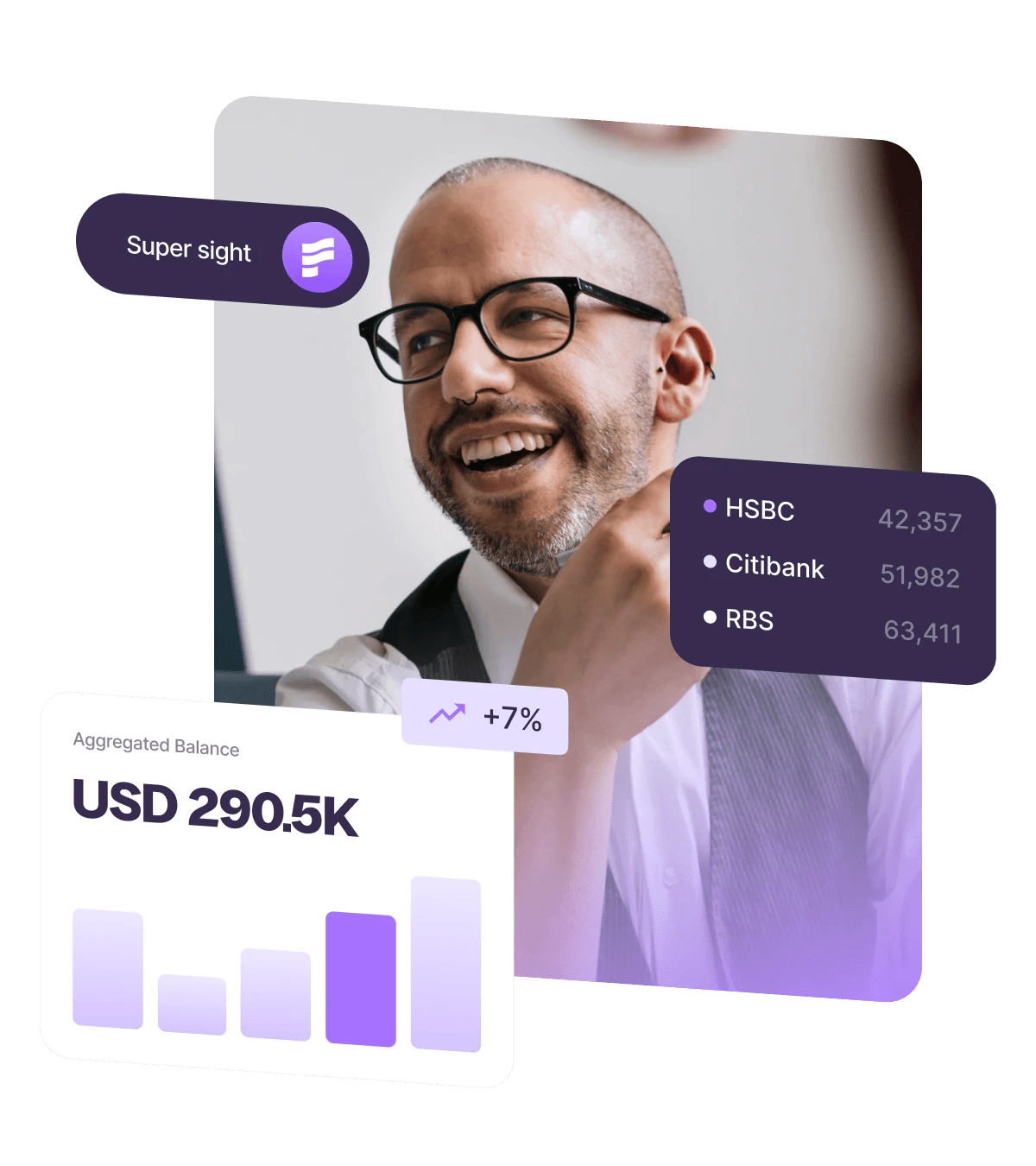

Do your morning review in moments

Complete cash management at-a-glance. Effectively track and forecast cashflow in one cash visibility dashboard.

Check your available cash balance for the current day in your base currency, or consolidated opening and closing balances.

Access account specific transaction histories or see a consolidated view across all accounts after syncing your bank accounts.

Get complete multi-currency cash visibility. Check balances in each account's native currency, plus an aggregated total in your chosen currency.

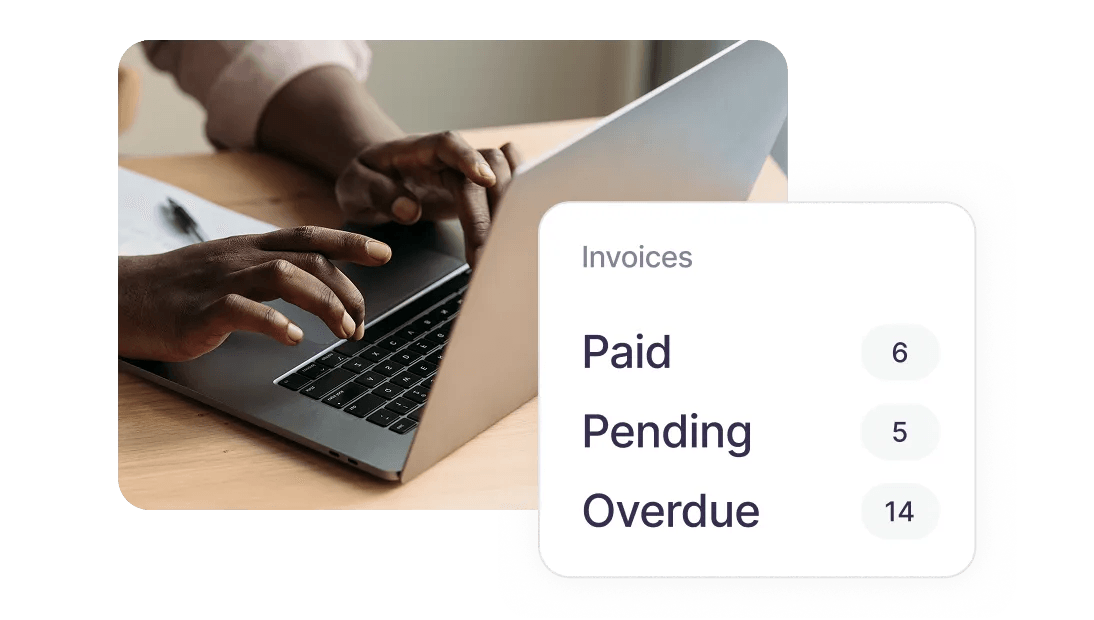

Review all your scheduled payouts that have been completed and line up bills to be cleared.

Easily track invoices that are awaiting payment and set reminders for ones that are late.

Cash management made easy. Access and review all transactions to check for any anomalies, or download them for further analysis.

Turn blind spots into strong points

Convert global balances into your base currency using live exchange rates, to give you clear visibility of your total cash position.

Improve cash management by overlaying your receivables and payables on your cashflow timeline. See what’s due, what’s delayed, and what’s coming up.

Filter your cash flow data by a specific date range or switch to a monthly or quarterly view to visualise trends over time.

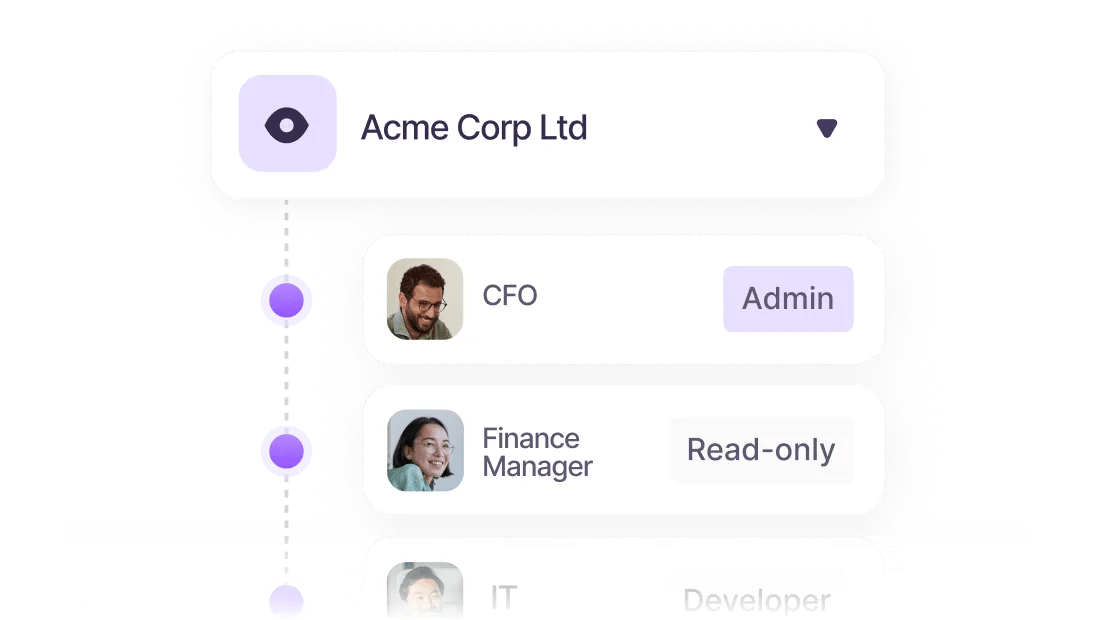

Get everyone on the same page with a single source of truth for the whole team. Assign access levels and permissions by role to ensure appropriate cash visibility – without compromising security.

Make payments smarter

Collect in 40+ currencies and pay-out in 200+ countries – with instant FX.

Try Finmo’s Cash Visibility Dashboard Today

Sign up to explore our cash visibility tool for yourself.

Or book a demo to talk things through with our team.