AP & AR automation for modern finance teams

Replace manual accounts payable and receivable processes with AP & AR automation software that schedules, approves, and reconciles invoices and payments in real time. Save time and stay in control of cash flow.

Scalable no‑code AP & AR workflows

Free up resources by eliminating manual accounts payable and receivable tasks. Automate invoice processing, approval routing, payment scheduling and financial reconciliation using simple, scalable no-code workflows

Smarter AR automation

Transform your accounts receivable into a streamlined, automated automation software. Get paid faster – while maintaining strong customer relationships.

Get instant visibility into your accounts receivables and customer behaviors. Track payment patterns, aging receivables, and cash flow metrics so you can act before issues arise.

View analytics on the share of invoices and overdue amounts linked to a particular customer. Identify high-risk accounts, prioritize those collections, and improve cashflow.

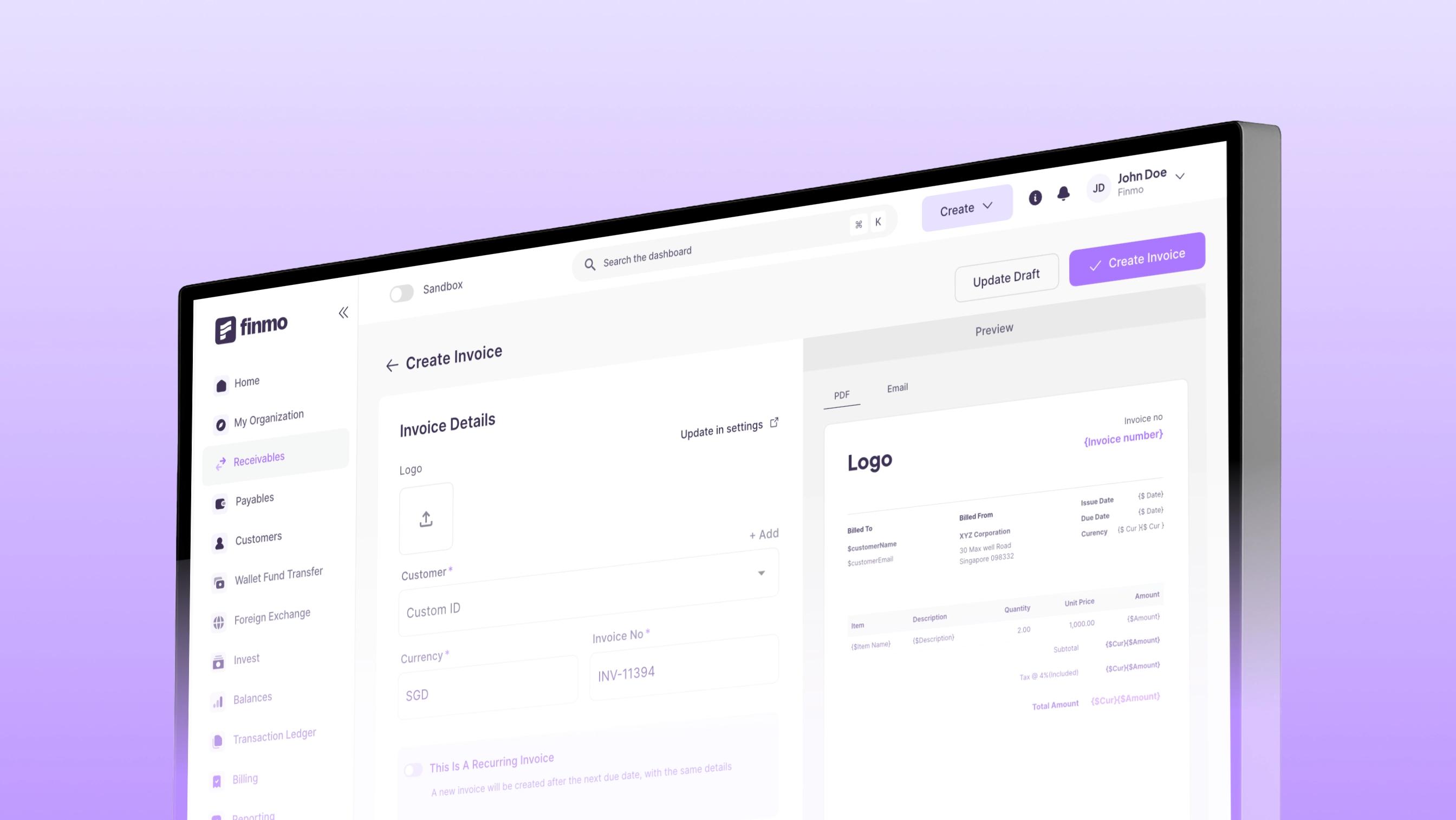

Automate invoice generation, recurring billing cycles and cross-border invoicing across business units. Streamline invoice processing to accelerate collections and improve cash flow predictability.

Send personalized, automated payment reminders and follow-ups to reduce late payments. Maintain strong customer relationships while improving on-time collections.

Give your customers a seamless experience to easily make instant payments.

Pain‑free AP automation

Streamline accounts payables with intelligent AP automation tools. Reduce invoice processing stay compliant, and optimise cash flow with smart payment workflows.

Get real-time visibility into your accounts payable with proactive alerts and automated insights. Track due dates, approval status and payment schedules so you never miss a deadline.

Upload invoices or receipts in PDF or image format. Finmo’s AI-powered OCR automatically extracts key data, reduces manual entry and feeds your accounts payable automation workflow.

Create one-off or recurring payables, with the option to schedule one-time payables. Automate payment workflows, manage FX conversion immediately, or on the scheduled date for that payment.

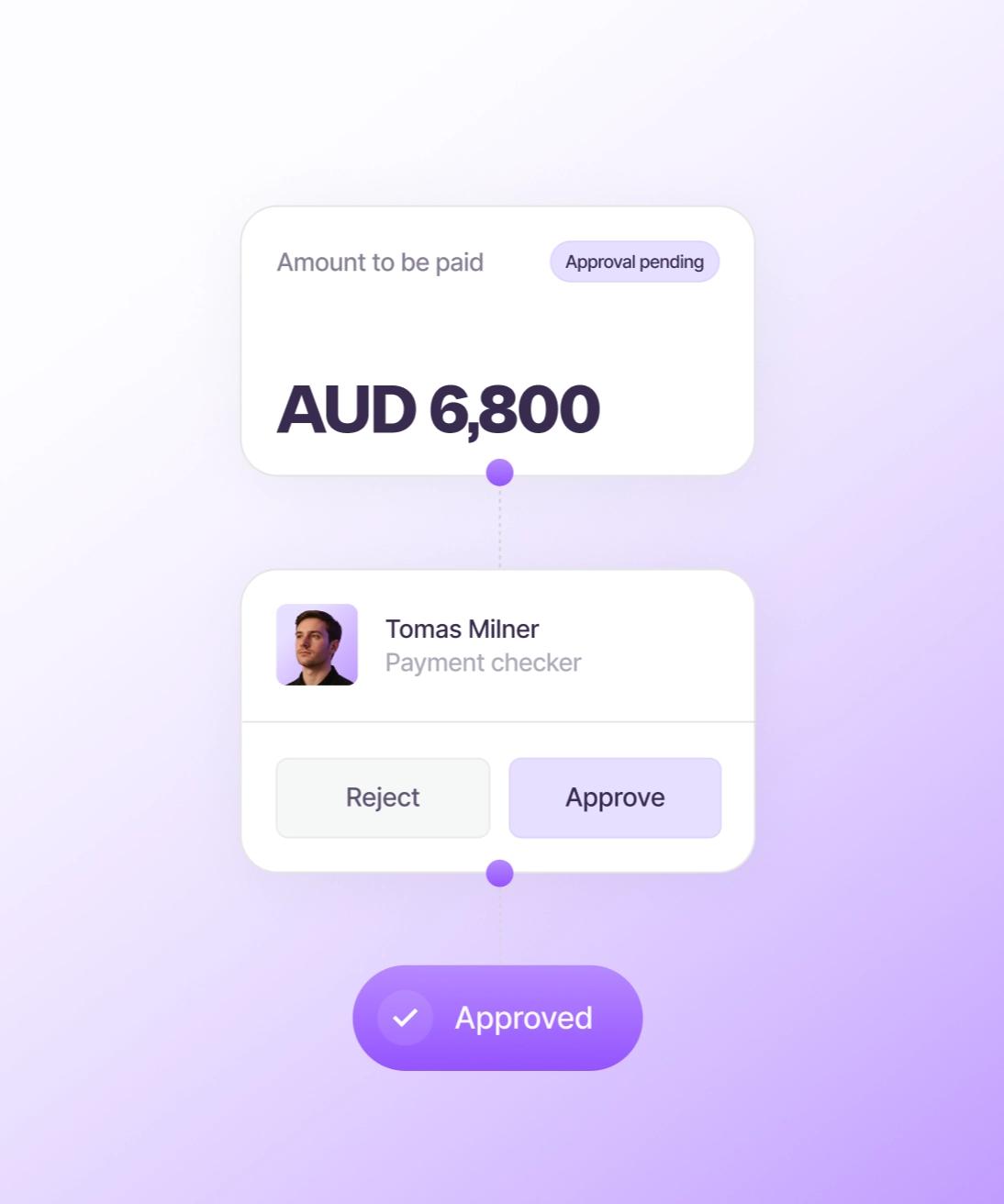

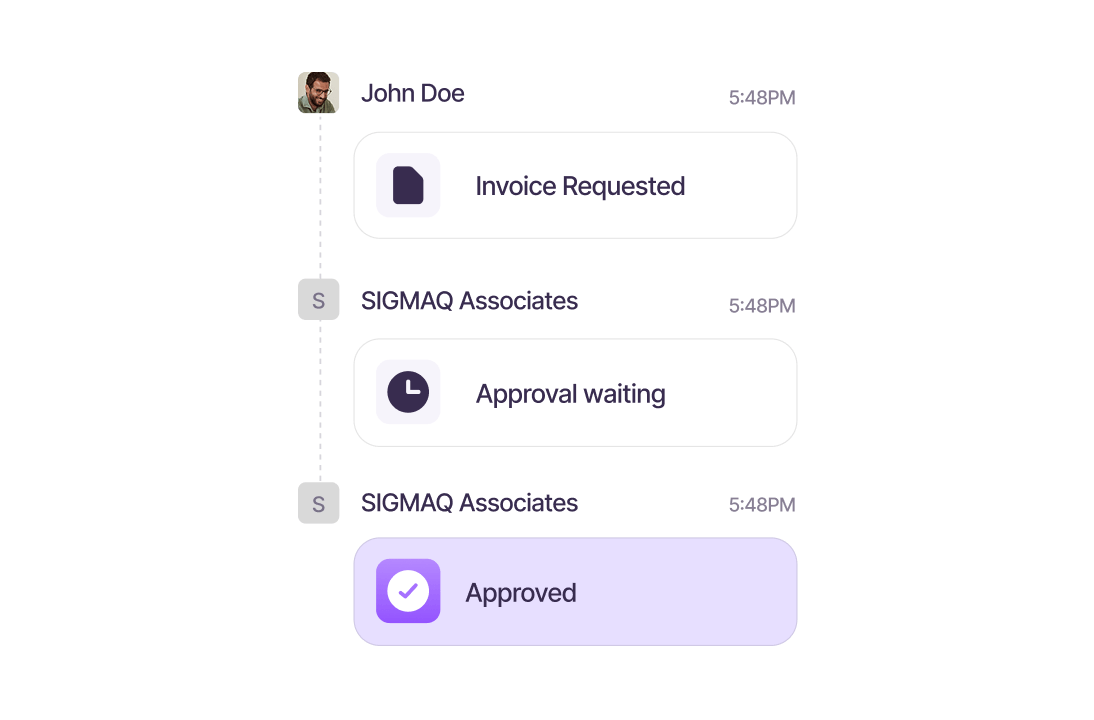

Remove friction and stay secure with dual approval workflows. Designate separate ‘payment makers’ and ‘payment checkers’, and get alerts when approvals are needed.

Finmo’s advanced invoice matching function, Smart Match, automatically suggests the most relevant pay-ins that can be linked to a specific invoice. Easily link pay-ins with their corresponding invoices, so that all invoices are reconciled correctly and no payments are left unlinked.

Scale and automate your payments with confidence thanks to embedded Maker-Checker security and full approval flows and audit trails – to demonstrate compliance at every step.

Take command of cashflow with connected forecasting

Forecast faster and smarter, collaborate more easily,and have the right data inform every business decision.

Try Finmo’s AP & AR automation tool today

Sign up to explore our dashboard for yourself firsthand.Book a demo to talk to our team.