Accounts Receivable Automation - Wallet as a Service

Back to all case studies

The Client

A Singapore based fintech startup, automating accounts receivable for SMEs

It holds a Major Payment Institution(MPI) license

100+ active clients in 2023 and expects to acquire 500+ in 2024

The Challenges

Integrate payments capabilities into its platform easily and securely to monetize on funds flow

Scale its platform with wallet configurations for flexible and instant funds movements between wallets

Simplify reconciliation and bookkeeping

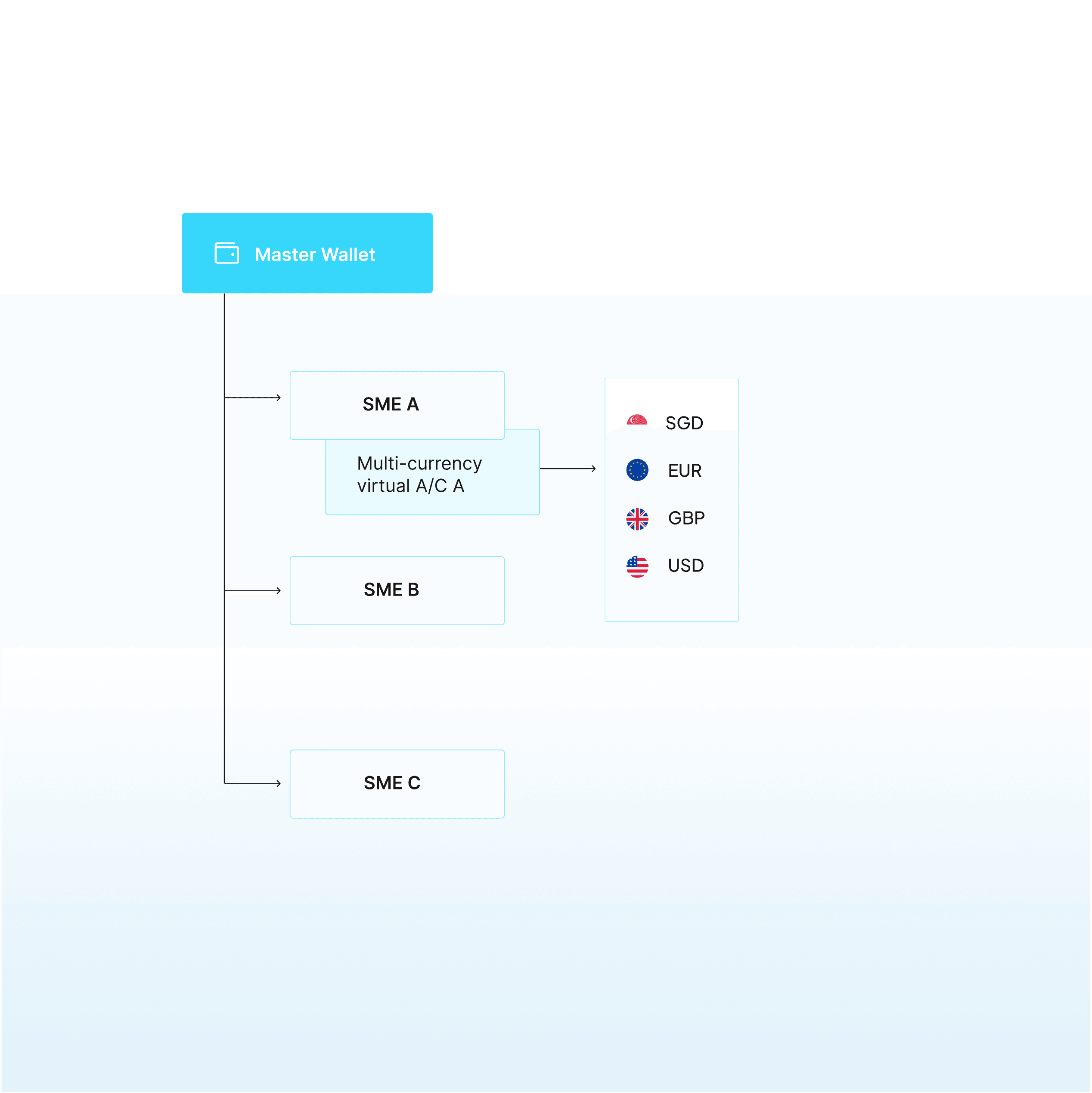

Collect and hold in multiple currencies, specifically in SGD, USD, EUR, and GBP

All of above without opening multiple bank accounts and banking relationships

Solution

Effortlessly integrate Finmo's innovative wallet-as-a-service solution to offer your clients a more robust payment experience

Create a multi-currency virtual account and assign it to a customer wallet. Finmo can hold these static identifiers against a customer wallet, so your customer can collect, load or hold funds

Move funds between wallets seamlessly and instantly

The Results

Finmo’s best-in-class technology solution provides seamless payments experience for your customers

Increase revenue by monetizing customers’ funds flow

Instant and zero-cost wallet to wallet funds movements

Simplified ledger management with master wallet and sub-wallet infrastructure

Centralized multi-currency account per customer

Transparent transaction and FX fee

Some more case studies you might like